Companies that advertise “I’ll buy your house for cash” are real estate investors who purchase homes directly from property owners. They offer a streamlined process, providing quick cash offers and fast closings, which can be appealing to homeowners seeking to sell their property fast.

While these companies come with certain benefits, there are also risks involved. This article will explore how these cash home buyers operate, the advantages and disadvantages of selling to them, and guide them on how to choose a reliable option.

The mainstream “we buy houses for cash” companies have gotten a bad reputation among regular citizens…

One User on Reddit Was Quoted Saying:

What Are ‘I’ll Buy Your House Cash’ Companies?

Companies that advertise “I’ll Buy Your House Cash” are typically cash home buyers focused on purchasing homes quickly and in their current condition from motivated sellers—those who may be financially distressed or own distressed properties in disrepair.

Compared to traditional home sales, these home-buying companies offer a more attractive option for some sellers. The ability to sell a home as-is is a significant part of the appeal for cash home buyers.

This feature allows homeowners to receive a fair cash offer for their property, helping them address issues such as foreclosure, ongoing carrying costs, and the expenses associated with renovations and repairs.

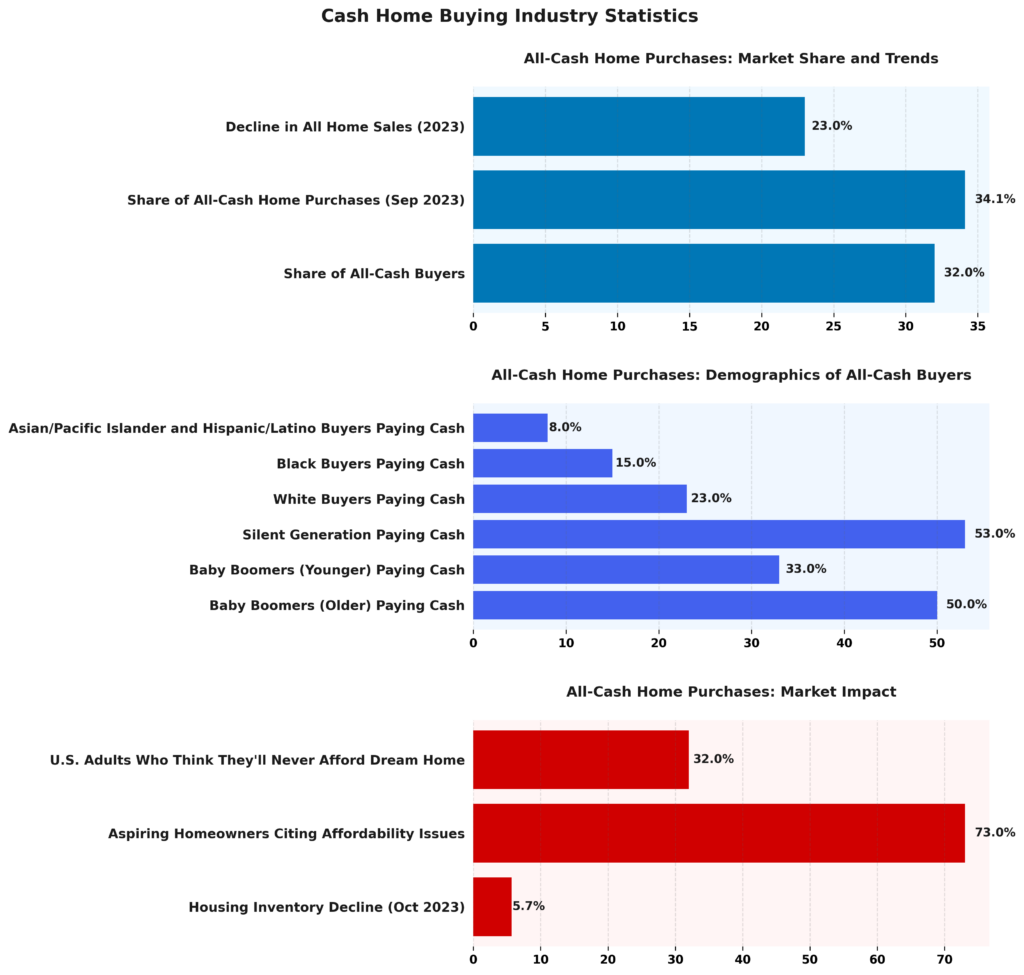

Cash Home Buying Industry Statistics

The Cash Home Buying Industry Statistics provides a comprehensive overview of the dynamics and demographics of all-cash home purchases, highlighting significant housing market trends and their impact on the real estate sector.

All-Cash Home Purchases data indicates a notable presence in the market, with 32.0% of home buyers purchasing homes outright with cash. This trend saw a slight increase to 34.1% in September 2023, showcasing a growing preference or necessity for cash purchases in the housing market.

However, overall home sales experienced a 23.0% decline in 2023, suggesting potential market constraints or economic factors affecting broader real estate transactions.

- Demographics of All-Cash Buyers: The data reveals that older generations dominate cash purchases. 50.0% of older Baby Boomers and 53.0% of the Silent Generation are paying cash. Younger Baby Boomers contribute 33.0% to this trend, reflecting their financial stability and possible downsizing motives. In contrast, cash purchases among racial groups are lower, with 23.0% of White buyers, 15.0% of Black buyers, and only 8.0% of Asian/Pacific Islander and Hispanic/Latino buyers opting for cash transactions. This disparity may highlight economic inequalities and varying access to financial resources across demographics.

- Market Impact: The housing market sees a 5.7% decline in inventory as of October 2023, which could be influenced by the prevalence of cash buyers swiftly closing deals. Affordability issues are a significant concern, with 73.0% of aspiring homeowners struggling with costs. Moreover, 32.0% of U.S. adults express doubt about ever affording their dream home, indicating a perception of unattainable housing goals for many.

In summary, the data underscores the complex interplay of cash purchasing power, demographic factors, and broader economic challenges in the real estate sector. Older generations and financially secure individuals are more likely to leverage cash deals, while affordability and inventory issues continue to challenge the aspirations of many prospective homebuyers.

Addressing these challenges requires policy adjustments and market innovations to enhance affordability and accessibility for a diverse range of buyers.

How Do These Companies Operate?

Cash home-buying companies offer a quick and hassle-free way to sell a house by streamlining the selling process. They typically provide competitive cash offers based on a thorough property valuation that takes into account current market conditions and the property’s condition.

This approach allows sellers to bypass traditional home appraisals and the associated closing costs.

1. Marketing Strategies

In a competitive real estate market, cash home-buying companies employ various investor-buying strategies to attract motivated sellers. They utilize online property listings to highlight the benefits of cash home buying, such as quick closing times and the ability to sell without making repairs or renovations.

These companies implement robust digital advertising campaigns that target specific demographics, leveraging search engine optimization and pay-per-click methods to enhance their visibility. Additionally, they engage with potential sellers in real time on social media platforms, sharing testimonials and examples of successful transactions to build credibility.

To further strengthen their reputations, these companies participate in local outreach efforts, including attending community events and partnering with local real estate agents. By combining these strategies, they create a holistic approach that resonates with homeowners seeking a streamlined selling process.

2. Property Evaluation Process

The property evaluation process utilized by cash home-buying companies involves several steps to determine a fair market value for the property. This process typically includes a home inspection, market analysis, and consideration of any necessary repairs, ultimately resulting in a final cash offer to the homeowner.

Homes4Cash.com explains that the evaluation begins with a professional home inspection, during which the structural integrity, systems, and overall condition of the property are assessed.

Next, a comparative market analysis is conducted, which is a crucial aspect of the home valuation process. This analysis evaluates similar properties or comparable sales (comps) in the area to identify current market conditions and pricing.

Cash buyers streamline this process by focusing on homes located in neighborhoods that are likely to sell quickly and easily, ensuring a smoother selling experience for the homeowner. They set specific standards for these neighborhoods, taking into account the average price of homes, their condition, and the desirability of the area in both local and broader economic contexts.

Additionally, external factors such as economic indicators—like local unemployment rates and job availability—can influence the demand for homes in a given area, affecting the overall market value.

The final offer presented to the homeowner at the end of the evaluation process reflects all of these elements, ensuring that cash buyers can provide a fair and reasonable offer that accurately represents the home’s value in a distressed sale, as well as current market conditions. This transparent transactions approach helps homeowners make informed decisions.

3. Closing the Deal

Closing cash home sales is generally easier than closing traditional home sales. Cash transactions involve fewer closing costs compared to those that require lenders, as many of the real estate closing fees associated with traditional transactions are eliminated.

This simplification allows for a much quicker process when transferring the title and issuing the formal closing statement. The ease of cash transactions is primarily due to the absence of a lender, which means that financing contingencies—often responsible for slowing down the process due to extensive underwriting and approval steps—are not a factor.

In a cash sale, the buyer provides the payment upfront. The documentation required for closing is typically limited to a purchase agreement, seller disclosures, and title insurance policies.

The title company verifies that the title is free of any liens and encumbrances and manages the escrow account until the sale’s contingencies are fulfilled. This crucial step in the title search and title insurance process ensures a secure transaction. With fewer obstacles to navigate, both the buyer and seller can finalize the transaction and transfer ownership much more quickly.

What Are The Benefits Of Selling To These Companies?

Selling your home to cash home buyers offers numerous benefits, particularly for homeowners who need to sell quickly, wish to avoid making repairs, or are not interested in waiting for traditional home financing. This option is also beneficial for those looking to bypass agents and avoid real estate commissions.

This option is especially advantageous for those seeking foreclosure help, as cash home-buying companies can provide quick cash offers. This allows homeowners to swiftly access the equity in their homes and promotes financial freedom.

1. Quick and Easy Process

One of the most significant advantages of selling to cash home buyers is the speed at which the process can be completed. Many companies are able to provide quick cash offers within days, allowing the entire home-selling process to be expedited considerably.

This speed benefits sellers by enabling them to finalize the sale in a fraction of the time it would take under traditional circumstances, while also minimizing the need for home-selling tips that may be necessary in more complicated situations. Furthermore, the streamlined process helps sellers avoid common home-selling pitfalls.

By eliminating lengthy negotiations and repairs, the seller can enjoy a much more straightforward selling experience. Additionally, since cash offers do not require buyer financing options, there is significantly less risk of the sale falling through, making the process less stressful and uncertain for the seller.

As a result, they can move on with their plans more quickly, making selling to cash buyers an attractive option for many.

2. No Need for Repairs or Renovations

Cash home-buying companies offer homeowners the option to sell their properties as-is, eliminating the need for costly renovations or home repairs. This approach alleviates concerns regarding the property’s condition and the seller’s disclosure requirements.

As a result, the home selling process becomes simpler, reducing the significant financial burden that often accompanies home improvement projects, where unexpected costs can escalate quickly. For many homeowners, the prospect of undergoing lengthy renovations can be mentally taxing and stressful, especially when they are pressed for time.

By choosing to sell their house fast and accepting quick cash offers, they can avoid extensive home repairs and expedite the selling process.

By collaborating with cash home-buying companies, they can bypass these challenges altogether, allowing for a quick and hassle-free sale of their homes as-is. Selling a home in this manner helps sellers avoid the financial expenses associated with contractor fees, materials, and extended timeframes. This also benefits real estate investors looking for investment properties in desirable locations, offering competitive offers for distressed properties.

3. Cash Offer and Fast Closing

Receiving a cash offer from a home-buying company often allows sellers to close on their property within days, facilitating a quick transition and enabling them to choose a closing date that meets their needs. This fast closing process is particularly advantageous for motivated sellers who wish to release home equity swiftly.

This expedited process can significantly reduce stress, as it eliminates the lengthy negotiation phase typical of traditional sales. Sellers may feel more comfortable knowing that cash offers minimize the need for a buyer’s agent, resulting in a more direct and uncomplicated relationship between the parties involved. Bypassing agents also help avoid real estate commissions, maximizing the cash sale advantages.

By removing the possibility of financing delays, sellers can confidently plan their next steps, fully aware of when the transaction will be completed. These clear timelines help foster trust, making negotiations feel more straightforward and less daunting, particularly for those managing multiple aspects of a sale.

The streamlined process typical of cash transactions ensures that seller disclosures and closing paperwork are efficiently managed, reducing selling fees.

What Are The Risks Of Selling To These Companies?

Selling to cash home-buying companies has its drawbacks. Most significantly, sellers may receive lower offer prices compared to traditional sales, often due to the property’s condition evaluation and market value considerations.

Additionally, there is a risk of potential scams and limited market reach, both of which can negatively impact profits for sellers. Conducting a thorough housing market analysis and understanding real estate trends can help sellers mitigate these risks.

1. Lower Offer Price

The primary disadvantage homeowners face when selling their homes to cash-buying companies is the likelihood of receiving an offer that falls short of the property’s fair market value.

This often occurs due to the absence of a formal home appraisal in these transactions and the negotiation tactics employed by cash-buying companies, leaving sellers in a vulnerable and uncertain position. Understanding buyer financing options and market conditions is crucial for negotiating a fair cash offer.

To counter this, homeowners should educate themselves about their local real estate market and understand the factors that can influence their cash offer, such as the condition of the property, neighborhood demand, and recent sales prices of comparable homes.

Engaging in a buyer’s market analysis and acquiring insights into investor buying strategies can provide an edge during negotiations.

Homeowners may also consider making minor repairs or improvements to their property before selling it to attract prospective buyers. Conducting local market research and comparing the findings against the cash-buying company’s initial offer can enable homeowners to make more informed decisions during the negotiation process.

Understanding the home buying process can help in assessing whether selling without a realtor might be an advantageous option.

If they choose to negotiate with cash buyers, the insights gained from in-depth market analysis equip them with the necessary tools to challenge low offers and secure a price that more accurately reflects their home’s true value. Evaluating housing market trends and the potential for home valuation increases can bolster their negotiating position.

2. Potential Scams

Homeowners should exercise caution when selling their homes to cash home-buying companies, as some cash buyers may exploit properties in poor conditions or situations involving foreclosure. This highlights the importance of conducting due diligence and performing thorough title searches. Securing title insurance and consulting legal requirements ensures seller safety and reduces home-selling pitfalls.

Sellers should begin by researching the company’s reputation through online reviews and ratings from organizations such as the Better Business Bureau or Trustpilot. Investigating real estate investor backgrounds and their property management practices can offer additional layers of assurance.

It’s advisable to ensure that the company is licensed and has a physical office, as this often indicates a higher likelihood of being a stable and legitimate buyer. Consulting with real estate agents or lawyers can also provide valuable insights into the reasonableness of the buyer’s offers. Understanding cash vs mortgage dynamics can guide seller motivation and decisions.

Homeowners should never feel pressured to make a hasty decision; taking the time to evaluate multiple offers can reveal important information that helps them avoid scams. Transparent transactions and clearly defined selling options contribute to a more secure selling experience.

3. Limited Market Reach

Selling to cash home-buying companies can limit a seller’s exposure to the broader market, as these companies often establish parameters that do not accurately reflect the overall real estate landscape. This can lead to sellers losing money when market conditions change. Addressing market appeal and tapping into motivated sellers can improve competitive offers.

Due to these parameters, sellers may receive less than they would if they engaged in the traditional selling process, where multiple competing buyers could drive up the price. The presence of real estate commissions in traditional sales can, however, affect the net profit from such transactions.

To negotiate better terms with cash home-buying companies and to find buyers without cash restrictions, it is essential to engage the services of a buyer’s agent. This can assist in bypassing agents’ fees and obtaining fairer market value for the property.

How To Choose A Reputable ‘I’ll Buy Your House Cash’ Company?

To find a reliable company that buys houses for cash, it is essential to conduct thorough research and due diligence. This includes verifying home buyer representation and ensuring the company follows stringent real estate closing procedures.

This involves comparing different companies, analyzing reviews and testimonials from previous clients, and requesting references to verify their trustworthiness and the advantages of cash buying. The process should also include examining the company’s real estate investment strategies and understanding how they handle both distressed property and equitable market transactions.

1. Research and Compare Companies

Homeowners should begin by conducting a thorough market analysis and researching various cash home-buying companies. It is important to compare offers and understand each firm’s investment strategy to make informed decisions. Recognizing the influence of housing market trends and property listings can further refine their analysis.

This initial phase involves gathering data on multiple companies, focusing on their past performance, customer feedback, and the specific terms they offer. Homeowners need to evaluate what each firm can provide in terms of purchase price and closing timeline. Considering selling options that include cash transactions can help streamline the overall process.

Additionally, they should be vigilant for hidden costs or requirements that could diminish the benefits of the cash transaction. By compiling this information, homeowners can gain a clearer understanding of which cash home-buying companies are more favorable, ultimately enabling better decision-making. Evaluating offer acceptance scenarios and sale price negotiation tactics can further enhance their selling strategy.

2. Read Reviews and Testimonials

Reviews and testimonials from previous sellers can provide valuable insights into how other homeowners have experienced working with cash home-buying companies. This feedback can aid homeowners in assessing the quality of seller representation and overall satisfaction. Identifying seller motivation and real estate due diligence practices can lead to more transparent transactions.

First-hand accounts can highlight not only a company’s strengths, professionalism, and reliability but also its weaknesses and potential pitfalls that may arise during the selling process. Understanding potential foreclosure help and distress sales experiences can be particularly enlightening for sellers dealing with challenging situations.

Prospective sellers should read reviews across various platforms, including Google Reviews, Yelp, and social media, where past clients share feedback about their experiences with specific firms or services. They should pay attention to the overall tone of the reviews and look for consistent themes, as well as ensure that the responses appear to come from genuine individuals with real interactions. This approach helps gauge the cash buyer service quality and highlights any home-selling pitfalls encountered by previous homeowners.

Red flags to watch for include overly positive reviews that are vague, generic, or suspiciously similar to one another, as these may indicate falsified testimonials. A balanced mix of positive and negative feedback often provides the most accurate indication of the level of service and helps homeowners make informed and confident decisions. Reviewing real estate trends and investor buying strategies can also aid in assessing the company’s overall market approach.

Frequently Asked Questions

What do those “I’ll buy your house cash” companies do?

These companies offer to purchase your house with cash, rather than going through the traditional process of listing it on the market and waiting for a buyer.

How do they determine the price they are willing to pay for my house?

These companies will typically evaluate the current market value of your house, taking into account any repairs or updates needed, and make an offer based on that information.

Do I need to pay any fees or commissions when working with these companies?

No, these companies do not charge any fees or commissions when buying your house. They make their profit by either flipping the house or renting it out.

What is the process like when working with these companies?

The process is typically fast and straightforward. Once you contact the company, they will schedule an appointment to view your house and make an offer. If you accept the offer, they will handle all the paperwork and close the sale quickly.

Are there any risks involved in working with these companies?

There are some risks involved, as with any real estate transaction. It’s important to research the company and read reviews before agreeing to sell your house to them. You may also want to consult with a real estate agent to ensure you are getting a fair offer.

Is this a good option for selling my house quickly?

It can be a good option if you need to sell your house quickly or if you are facing financial difficulties. However, it’s important to weigh the offer against the potential profit you could make by listing your house on the market.