When you inherit a house, you may find yourself with a property that you do not want or cannot afford to maintain. In such cases, selling the inherited house may be the best option. However, selling an inherited house can be a challenging process, especially if you are not familiar with the legal and financial requirements involved. This article provides a step-by-step guide on how to sell an inherited house fast in Denver, Colorado.

Need To Sell Your House Fast?

We buy houses in ANY CONDITION! We pay CASH and you will not pay any commissions, agents, or fees. Put your address and email below and answer 5 easy questions on the next page to get a cash offer in 24 hours! Privacy Guaranteed!

Understanding the Legal and Financial Requirements

Before selling an inherited house, it is crucial to understand the legal and financial requirements involved. These include:

1. Probate Process

In Colorado, the probate process is required to distribute assets of the deceased person, including real estate property. The probate process can take several months to complete, and the executor of the estate is responsible for managing the process.

2. Title and Deed

The title and deed of the inherited house must be transferred to the new owner. This process involves legal paperwork that must be filed with the county clerk and recorder.

3. Taxes

Inherited property may be subject to estate and capital gains taxes, depending on the value of the property and the amount of time between the date of inheritance and the date of sale.

Preparing the Inherited House for Sale

Before selling the inherited house, it is essential to prepare the property for sale. This includes:

1. Cleaning and Decluttering

The inherited house may need some cleaning and decluttering to make it more appealing to potential buyers. You may need to hire a professional cleaning service to help you with this task.

2. Repairs and Renovations

If the inherited house needs any repairs or renovations, you should consider completing them before putting the property on the market. This can increase the value of the property and attract more potential buyers.

3. Staging the Property

Staging the property involves arranging furniture and decor to create an appealing atmosphere for potential buyers. This can help buyers envision themselves living in the property.

Pricing and Marketing the Inherited House

Once the inherited house is ready for sale, it is time to price and market the property. This includes:

1. Pricing the Property

Determining the right price for the inherited house is crucial to attracting potential buyers. You should consider the current market conditions, the location of the property, and any repairs or renovations you have completed.

2. Marketing the Property

Marketing the inherited house involves creating a listing with photos and a detailed description of the property. You may need to hire a real estate agent to help you with this process.

3. Showing the Property

Potential buyers may request to view the inherited house. You should be prepared to show the property and answer any questions potential buyers may have.

Closing the Sale of the Inherited House

Once you have found a potential buyer for the inherited house, it is time to close the sale. This involves:

1. Negotiating the Sale

You may need to negotiate the sale price with the potential buyer. This can involve counteroffers and compromises.

2. Signing the Purchase Agreement

Once the sale price is agreed upon, a purchase agreement is drafted and signed by both parties.

3. Completing the Title Transfer

The title transfer involves filing legal paperwork with the county clerk and recorder to transfer the title and deed of the inherited house to the new owner.

Selling an inherited house can present both emotional and logistical challenges. From assessing its value to navigating legal implications, every step requires careful consideration. This guide outlines the essential steps to streamline the selling process, highlighting the benefits of a quick sale as well as the potential challenges you may encounter. If you are looking to sell an inherited property in Denver, Colorado, expert tips will assist you in achieving a fast and successful sale.

What are the Steps to Sell an Inherited House?

Selling an inherited property is a multi-step process that can significantly impact the outcome, particularly in the competitive Denver real estate and Colorado property market.

The process starts with understanding the emotional aspects and financial implications of selling a family inheritance. It also involves addressing home valuation, property valuations, and the legal requirements associated with the probate process, including property disclosure.

By effectively navigating these challenges, the sale can be expedited, allowing the property to be sold quickly at its fair market value.

1. Determine the Value of the Inherited House

The value of a house is the most crucial aspect of selling inherited property, as it forms the foundation of the pricing strategy and influences how appealing your property listing is to potential buyers and cash buyers.

A qualified appraiser should conduct a home appraisal, utilizing various methods of comparative market analysis and property inspections to establish fair market value.

The significance of property valuation lies in its ability to establish a fair market value that attracts buyers while ensuring your listing is competitively priced within local market trends.

These trends indicate how similar properties have fluctuated in value, enabling the seller to set a price that reflects current demand and buyer interest. Understanding this information will help you achieve the best return and facilitate a smoother selling process.

2. Decide Whether to Keep or Sell the House

Deciding whether to keep or sell an inherited house is one of the most challenging decisions faced by inheritors, as it often involves a deeply emotional struggle between sentiment and estate planning considerations. Inheritors may feel torn between cherished memories of family celebrations and the desire to honor their loved one’s legacy while considering selling options including selling to investors.

Even if they opt to sell the house, they can still commemorate their loved one by purchasing a memorial bench, tree, or another structure in their memory.

It is also important to consider the potential for rental income that the property may generate, which could significantly alleviate financial pressure. Factors such as maintenance costs and the current real estate market can greatly influence this decision; for some, selling may prove to be the better choice.

This option can provide leverage for other investments or estate planning, allowing heirs to utilize the funds more effectively for their future needs. Ultimately, it is crucial to strike a balance between emotional attachment and financial realities when making these difficult decisions.

3. Prepare the House for Sale

Preparing a house for sale is essential for attracting buyers and achieving a quick sale. This process begins with assessing the property’s condition and identifying necessary home repairs and improvements that could enhance its appeal.

Property staging plays a crucial role, as it allows potential buyers to envision themselves in the space while highlighting the home’s best features and neighborhood appeal.

Evaluating renovation costs is also an important step, ensuring that any updates provide a good return on investment without exceeding the budget.

Enhancing curb appeal is vital, as first impressions are formed quickly and can significantly influence buyer interest.

By considering these factors, sellers can effectively tailor their approach to attract specific buyer demographics and set competitive pricing, ultimately leading to a successful sale.

4. Find a Real Estate Agent or Sell on Your Own

Deciding whether to work with a real estate agent or to sell an inherited house using FSBO (for sale by owner) techniques is a significant choice that can greatly influence the ease and outcome of the sale. This decision involves considering various factors, including the seller’s level of expertise, local market dynamics, and the unique emotional attachments often associated with inherited homes.

While real estate agents bring strong negotiating skills and access to a broader range of marketing techniques, FSBO sellers must conduct their own research and utilize their resources to attract potential buyers’ interest in their properties. Understanding the distinction between these two selling methods is essential for anyone planning to sell an inherited home.

Ultimately, the best approach for each individual will depend on their unique circumstances and a realistic evaluation of their ability to navigate the challenges of the real estate market.

5. Advertise the House

Effective advertising plays a crucial role in helping motivated sellers attract potential buyers for their inherited homes by utilizing online listings and platforms that create and promote compelling property listings while showcasing local neighborhood amenities.

A well-crafted property listing not only highlights the unique selling points of the home but also resonates with the emotional connections buyers may have with their future residences.

Open house events are an excellent way to foster this emotional connection, as they allow visitors to envision themselves living in the home. Social media, whether through free or paid promotions, can reach a broader audience and generate interest from various demographics, including younger buyers who increasingly turn to online searches for properties.

By investing time and possibly money into high-quality photography and staging, sellers of inherited homes can enhance the perceived value of the property, attract the right buyers, and facilitate a quicker sale at a better price.

6. Negotiate and Accept an Offer

Negotiating and accepting an offer is a crucial milestone in the home-selling process. Understanding buyer financing and employing effective negotiation strategies can help sellers achieve optimal results.

Here are some tips for sellers on negotiating and accepting an offer:

- Navigating Buyer Financing: Sellers should carefully assess the various buyer financing options presented by buyers. For instance, cash offers often allow sellers to close more quickly than financed offers. If a seller is considering seller financing—where the seller provides a loan to the buyer—they should evaluate the terms meticulously and ensure that the buyer is creditworthy to minimize risk.

- Multiple Offer Strategy: When faced with multiple offers, sellers need to adopt a strategic approach to select the best one. Outlining the pros and cons of each offer can serve as a helpful tool in this decision-making process.

- Seller Focus on Buyer Contingencies: Sellers should be aware of any contingencies from buyers, as understanding these can give insight into whether an offer is likely to close smoothly. This awareness can also aid sellers in negotiating the best possible terms.

7. Complete the Sale Process and Title Transfer

Completing the sale process involves several crucial final steps, including understanding closing costs, title transfer, and adhering to the closing schedule. As the closing deadline approaches, it is essential for all parties involved to gather the necessary closing paperwork, clearly understand who is responsible for various payments, and ensure that funds are properly distributed.

Closing costs can vary significantly, so effective planning is key to managing these expenses. A vital aspect of the real estate closing process is the transfer of the title and deed, which ensures that ownership is properly documented.

Additionally, the involvement of a real estate lawyer can protect both buyers and sellers by ensuring that all legal requirements are met, thereby minimizing the potential for future disputes.

What Are the Benefits of Selling an Inherited House Fast?

Quickly selling an inherited house can help avoid maintenance and upkeep costs while providing immediate cash flow. This can be advantageous for effective financial planning and addressing tax implications, especially in a buyer’s market.

1. Avoiding Maintenance and Upkeep Costs

One of the key advantages of selling an inherited house quickly is the avoidance of ongoing maintenance and upkeep costs, which can burden the estate and affect the overall condition of the property.

By selling the property promptly, heirs can circumvent additional expenses related to property taxes, insurance, and necessary repairs. These costs can accumulate rapidly, placing extra pressure on heirs during an already challenging time.

When a home is left unoccupied, its condition often deteriorates, resulting in even higher repair bills later on. By selling quickly, heirs can identify potential repairs sooner and address them, making the home more marketable and potentially enabling a higher selling price.

Therefore, a swift sale not only has financial implications but also helps facilitate a smoother transition and resolution for those managing the estate.

2. Avoiding Capital Gains Tax

Avoiding capital gains tax is a significant benefit of selling an inherited house quickly, as it can lessen the financial burden of inheritances and taxes during the estate settlement process, especially in the current real estate investment climate.

By acting promptly, individuals can often take advantage of the stepped-up basis rule, which allows the basis of the house to be adjusted to its fair market value at the time of the previous owner’s death. If the inherited property is sold shortly after the inheritance, any appreciation in value that occurs afterward may not be subject to taxation, making it an attractive option in the Colorado property market.

Additionally, strategic estate planning regarding timing—such as understanding the differences between short-term and long-term capital gains—can greatly enhance financial outcomes. Consulting with financial advisors is the best approach to receiving personalized guidance tailored to an individual’s situation, particularly when dealing with the probate process and other legal considerations.

These professionals can navigate the complexities of the tax code and ensure that all potential deductions and credits are maximized, which is crucial during a home-selling process involving an inherited estate.

3. Getting Cash Quickly

Fast house sales, often pursued by motivated sellers, can generate cash quickly, providing short-term financial relief and facilitating better financial planning for the future.

The process of selling a house rapidly attracts cash buyers who can access funds immediately, resulting in a quicker closing and sales process without delays associated with mortgage approvals from banks.

This immediate conversion of a house into cash is particularly beneficial in situations of financial distress, such as medical emergencies or sudden financial burdens, where quick closing and cash offers are essential.

The liquid assets gained from a fast sale can be reinvested right away into other ventures that offer higher potential returns. Additionally, quick access to cash serves as a cushion for financial stability against unexpected shocks and creates more opportunities for future real estate investment and other investments.

What Are the Challenges of Selling an Inherited House Fast?

Selling an inherited house quickly can offer certain advantages, but it also presents specific challenges.

These challenges often involve emotional aspects, family dynamics, and various legal obligations that must be navigated with care.

1. Dealing with Emotions and Family Dynamics

The most challenging aspect of selling an inherited home often lies in the emotional hurdles, which are typically exacerbated by family dynamics and the potential for disputes over the inheritance.

Individuals frequently grapple with feelings of sadness, guilt, and other conflicting emotions as memories and associations related to the home resurface. This can lead to turmoil among family members, particularly when there is disagreement on how to manage the inherited property.

To address these issues, families can establish effective communication systems. Family members must express their feelings and expectations openly to help alleviate tension.

Additionally, it is important to recognize that everyone grieves differently, and each person’s voice should be acknowledged in discussions about decisions. Family meetings, the involvement of a mediator, and other strategies can facilitate conversations about practical concerns while remaining sensitive to the emotional aspects of the situation, including the decision to sell inherited house assets.

2. Understanding the Legal and Tax Implications

When selling an inherited house, it is essential to consider the legal and tax implications, as they can significantly impact both the home-selling process and the financial outcomes.

Understanding the probate process is crucial, as it determines how the deceased’s property is officially transferred to the heirs. Typically, executors or administrators must file a petition in court, although the specifics of this process can vary by jurisdiction. This step can be time-consuming, as numerous legal requirements and obligations must be fulfilled before a sale can proceed.

Estate planning plays an important role in this context, influencing property valuations and potential tax liabilities. Consulting with a qualified real estate attorney is necessary to navigate these complexities and ensure compliance. An attorney can also help clarify the various tax implications, which may ultimately affect the net profit from the sale of the inherited estate.

3. Finding a Buyer Quickly

Selling an inherited home quickly can be challenging, especially in a changing market that influences buyer financing, demographics, and real estate trends.

In such circumstances, understanding whether the market is a buyer’s or seller’s market is crucial for developing effective selling strategies and determining the appropriate selling price evaluation.

In a buyer’s market, there are many available homes and lower prices, which often leads to longer selling times. Conversely, a seller’s market features fewer homes for sale, making it easier to attract buyers and receive higher offers, potentially increasing home selling timeline efficiency.

To increase the chances of a fast home sale, it is essential to:

- Properly stage the home

- Price it competitively based on recent comparable sales

- Employ marketing strategies and techniques that reach the widest audience possible through online listings and open-market strategies

Additionally, consulting with a knowledgeable real estate agent who specializes in the Denver real estate landscape can provide valuable insights and guidance.

How Can You Sell an Inherited House Fast in Denver, Colorado?

Selling an inherited house quickly in Denver, Colorado, necessitates the use of effective selling strategies, thorough market analysis, and a strong understanding of the local real estate landscape to attract potential buyers, including through property listing and comparative market analysis.

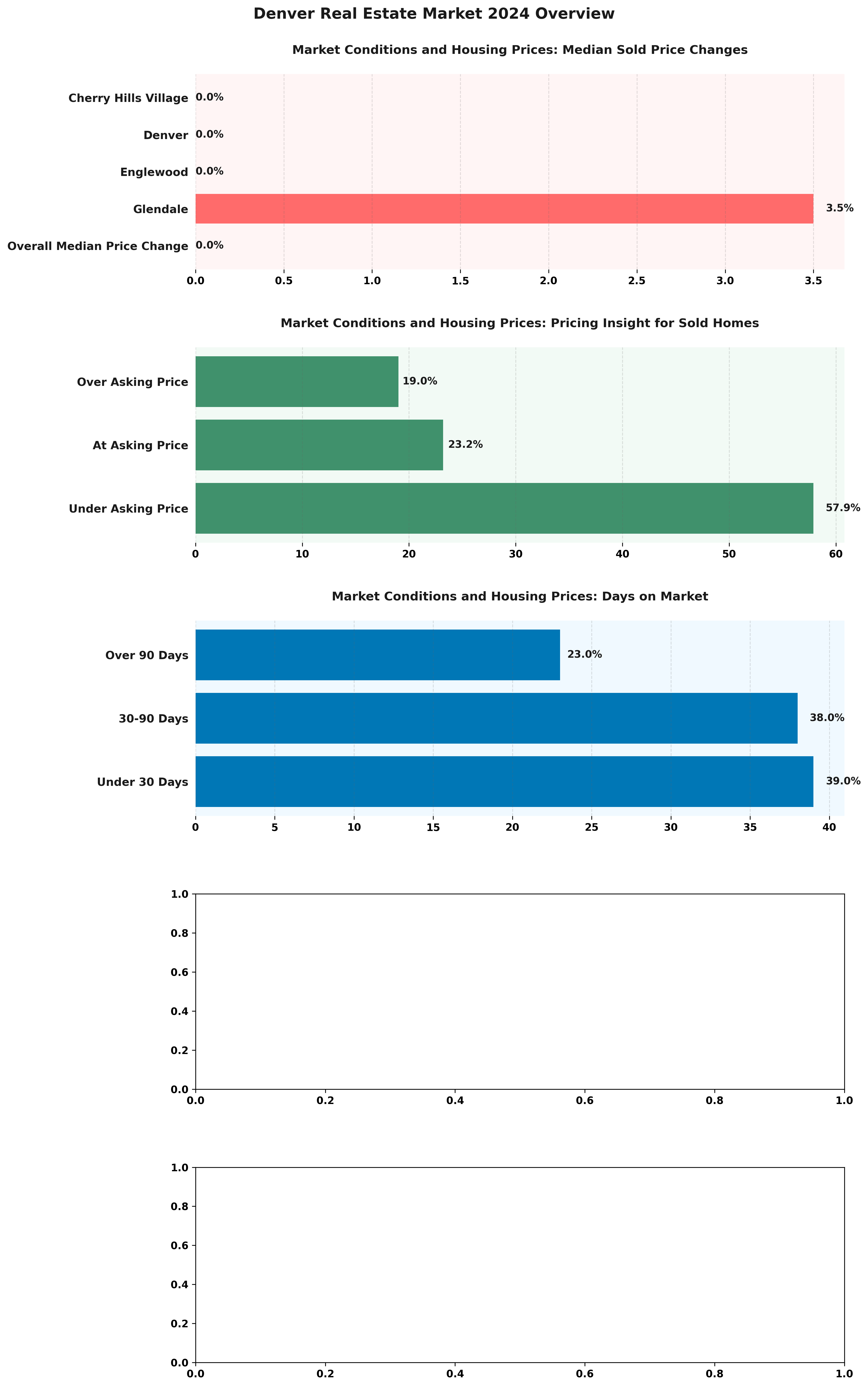

Denver Real Estate Market 2024 Overview

1. Work with a Real Estate Agent Who Specializes in Fast Sales

Working with a real estate agent who specializes in quick home sales is one of the most effective strategies for selling an inherited house rapidly in Denver’s competitive market, especially when considering property value assessment and online listings.

These professionals possess the knowledge and experience necessary to market the property effectively to potential buyers in this fast-changing environment. They are well-versed in local trends and can price the property appropriately, striking a balance between being over- and under-priced compared to similar homes.

For instance, a skilled agent may utilize unique marketing strategies, such as virtual tours or high-quality staging, to create a lasting first impression. Their negotiation expertise can also make a significant difference, potentially turning a low offer into a bidding war, which can expedite the sale process and maximize the sale price.

2. Consider Selling to a Cash Buyer

Selling to a cash buyer can significantly expedite the process of selling an inherited house. This option provides the urgency that many sellers seek, allowing them to complete sales without complications arising from buyer financing. Cash offers can reduce closing paperwork and simplify the title transfer process.

Not only does this speed up the transaction, but it also reduces the stress associated with potential buyer contingencies. Cash buyers are typically in a position to make expedited purchases, which is particularly beneficial for sellers of outdated or severely dilapidated houses that may deter traditional buyers due to the extensive home repairs required.

Additionally, sellers can often bypass the lengthy appraisal process that is commonly part of financed sales. In situations where there is time pressure due to foreclosure or urgent relocation, opting for a cash buyer offers a high degree of assurance and speed, ultimately putting the seller in a better position to move on.

3. Price the House Competitively

Competitively pricing a house is essential for attracting potential buyers and facilitating a quick sale in Denver’s competitive real estate market, especially considering the fluctuations in the Colorado property market.

Sellers can employ various techniques, including accurate property valuation, home appraisal, and market analysis, which involves comparing similar properties in the area—often referred to as “comps”—to establish a pricing baseline.

To determine these price points, sellers must understand buyer demographics, including preferences, age groups, and financial capabilities. For instance, a younger demographic may prioritize modern amenities and technology, justifying a higher price, while first-time home buyers are typically more price-sensitive. Home selling tips and local market trends can also guide sellers in setting a fair market value.

By aligning pricing strategies with market conditions and buyer demographics, sellers can enhance their chances of a successful sale, aided by effective selling strategies and comprehensive property market research.

4. Be Flexible with Negotiations

Flexibility in negotiations significantly increases the likelihood of successfully selling a home, especially in a competitive market with multiple offers, where motivated sellers might encounter various buyer offers.

Sellers who employ effective negotiation strategies can enhance their appeal to prospective buyers while creating opportunities for both parties to mutually agree on terms that may not have been initially considered. This includes negotiating closing costs and exploring buyer financing options.

For instance, exploring various financing options can attract buyers who might be constrained by conventional mortgage routes. This includes scenarios such as seller financing and cash buyers, which can allow for more favorable terms compared to traditional financing methods, ultimately benefiting both parties.

Ultimately, this flexibility fosters a more customized approach to negotiations, encouraging agreement and collaboration—elements that are often essential for closing a deal in a fast-paced market, especially during the home selling season.

5. Market the House Effectively

Various marketing strategies are employed to increase visibility, making effective marketing of a house essential for attracting buyers and ensuring a quick sale. Utilizing a wide range of strategies, such as property staging and leveraging real estate listings, can significantly enhance the appeal of the property.

Key marketing strategies include the following:

- Online Listings: Real estate websites serve as the primary point of contact for potential buyers, so it is crucial to present accurate information and high-quality images of the home.

- Open House Events: These events provide an opportunity for potential buyers to experience the home in a way that photographs cannot replicate, making them a crucial part of the home-selling process.

- Neighborhood Features: Including information about neighborhood amenities, such as parks, schools, and local shops, helps sellers create a more comprehensive picture of the lifestyle a buyer can expect, thereby enhancing neighborhood appeal.

- Targeting Specific Demographics: By focusing on particular buyer demographics, such as families or young professionals, sellers can emphasize features of the house that would be particularly appealing to those groups, aligning with local buyer networks and trends.

Implementing these strategies can greatly enhance the chances of a successful sale, particularly in a buyer’s market where effective property listing and real estate agent collaboration are essential.

Selling Your Inherited Denver Home to HBR Colorado

Selling an inherited house can be a complex process, but with the right knowledge and preparation, you can sell the property quickly and easily. Remember to understand the legal and financial requirements, prepare the property for sale, price, and market the property, and close the sale properly

As an expert real estate investment company that has been in the business for 10 years and operates nationwide, we understand the challenges and opportunities that come with investing in real estate. One of the keys to success in this industry is to have a deep understanding of the local markets where you operate, as each region has its own unique dynamics and trends that can affect property values and demand.

At our company, we have invested significant time and resources into developing a thorough understanding of the local markets where we operate, including factors such as demographics, job growth, and economic indicators. We also have a proven track record of success, with a portfolio of properties that have generated strong returns for our investors.

One area where we have found particular success is in buying inherited homes. Inherited homes can often present unique challenges, such as navigating probate laws and dealing with sentimental attachments to the property. However, we have developed a specialized approach that allows us to navigate these challenges effectively and provide a valuable service to those who are looking to sell their inherited homes.

Overall, we believe that real estate investing can be a highly lucrative and rewarding endeavor when approached with a strategic and informed mindset. We are committed to leveraging our expertise and experience to deliver strong returns for our investors while also providing value to the communities where we operate.

FAQs

1. Do I have to pay taxes on the sale of an inherited house in Denver, Colorado?

Inherited property may be subject to estate and capital gains taxes, depending on the value of the property and the amount of time between the date of inheritance and the date of sale. It is recommended to consult with a tax professional to determine your tax obligations.

2. Can I sell an inherited house without going through the probate process?

No, the probate process is required to distribute assets of the deceased person, including real estate property, in Colorado.

3. How do I determine the right price for the inherited house?

You should consider the current market conditions, the location of the property, and any repairs or renovations you have completed. It is also recommended to consult with a real estate agent to determine the right price for the property.

4. Do I need to hire a real estate agent to sell the inherited house?

No, you can sell the inherited house on your own, but hiring a real estate agent can help you with pricing, marketing, and negotiating the sale of the property.

5. How long does it take to sell an inherited house in Denver, Colorado?

The time it takes to sell an inherited house in Denver, Colorado, can vary depending on several factors, including the condition of the property, the asking price, and the demand in the local market. However, with the right preparation and pricing, you can sell the property quickly and easily.

6. Can I sell an inherited house in Denver, Colorado if there is a mortgage on the property?

Yes, you can still sell an inherited house in Denver, Colorado if there is a mortgage on the property. However, the mortgage will need to be paid off before the sale can be finalized. You can either pay off the mortgage with the sale proceeds or use other assets from the estate to cover the remaining balance.

7. What are some tips for selling an inherited house fast in Denver, Colorado?

To sell an inherited house fast in Denver, Colorado, it’s important to price it competitively, make necessary home repairs and upgrades, and stage the home for potential buyers. It can also be helpful to work with a real estate agent who has experience in selling inherited properties, navigating the title transfer, and managing the emotional aspects of an estate sale.

8. What should I do if I have inherited a house in Denver, Colorado but don’t want to keep it?

If you have inherited a house in Denver, Colorado but don’t want to keep it, you have a few options. You can sell the house, gift it to someone else, or transfer ownership to another family member. It’s important to consider the financial and emotional implications of each option before making a decision, including the legal considerations involved in an estate planning process.