The Colorado housing market has undergone significant changes over the past decade, influenced by various economic, demographic, and external factors, including the Great Recession and market fluctuations.

This article explores the factors that have affected housing prices, demand, and supply, along with their impacts on homeowners and renters, providing insights into real estate trends and housing policies.

Furthermore, it examines the current state of the market, recent trends, and what the future may hold for prospective buyers, existing residents, and real estate agents in this vibrant state.

The Housing Market in Colorado Over the Past Decade

Over the past ten years, the housing market in Colorado has experienced significant changes due to various economic influences, demographic shifts, and real estate market trends. This period has seen fluctuations in property values, evolving buyer preferences, and variations in home sales, along with other data points such as market saturation and housing bubbles that illustrate the complexities of Colorado’s real estate landscape.

The interplay of supply and demand, mortgage rates, and housing inventory shortages has also been crucial in shaping the current market conditions. Understanding these factors is essential for anyone looking to successfully navigate Colorado’s real estate market, including potential buyers and sellers.

Factors That Have Influenced the Housing Market in Colorado

- Low inventory:

- Colorado has struggled with a lack of housing inventory since 2011.

- In the Denver metro area, available homes for sale dropped from 11,839 at the end of 1990 to an all-time low of 1,477 in 2021.

- Strong demand:

- Population growth and economic factors have driven high demand for housing.

- Colorado’s population grew significantly, with Denver being a preferred destination for people moving from expensive cities.

- Economic growth:

- Colorado has seen a 25% increase in employment since 2010.

- New companies moving to the area have brought relocated employees and attracted new ones.

- Lagging construction:

- Home construction has not kept pace with population growth.

- Builders have struggled to meet demand due to various factors, including restrictive zoning laws.

- Historically low interest rates:

- Record-low interest rates, especially in 2020 and 2021, encouraged more buyers to enter the market.

- Demographic shifts:

- Millennials reaching peak homebuying years have increased demand, now making up 43% of homebuyers.

- Desirable lifestyle:

- Colorado’s outdoor activities, sunshine, and strong neighborhood character have attracted many new residents.

- Limited supply of land:

- Geographical constraints and zoning restrictions have limited the supply of buildable land in some areas.

- Investor activity:

- Increased short-term rental activity and investor purchases have contributed to price increases.

- Economic recovery post-2008:

- A decade of economic growth before the 2020 pandemic led to record-low unemployment and increased housing demand.

These factors combined have led to substantial price increases, with home values in some Colorado metro areas more than doubling over the past decade. For example, in the Denver metro area, the typical home value increased from $261,180 in 2013 to $573,399 in 2023, representing a 120% increase.

The housing market in Colorado has been influenced by a variety of factors, including economic trends, population growth, and urban development initiatives that affect both supply and demand dynamics, as well as migration patterns and suburban growth. As the state experiences significant population increases, particularly in suburban areas, the demand for housing has surged, resulting in rising rental prices and property values.

For buyers and investors alike, the affordability of homes and the availability of investment opportunities have become critical considerations. This surge in demand can largely be attributed to job growth in major sectors such as technology and renewable energy, making urban centers like Denver particularly appealing for both single-family homes and multifamily units. Additionally, low interest rates and mortgage approvals have created a favorable environment for home buying, encouraging potential homeowners to enter the market.

However, urban development faces challenges; stringent zoning laws, limited land availability, and housing legislation have exacerbated the housing crisis. For instance, the average home price in the Denver metro area has increased by over 15% in the past year, while vacancy rates have dropped to historic lows, forcing many individuals to seek rental options that often exceed their budget.

| Factor | Impact on Housing Inventory |

|---|---|

| Strong Demand | Increased demand from population growth and economic factors. |

| Lagging Construction | Insufficient housing supply due to various constraints. |

| Low Interest Rates | Increased buyer activity and competition for limited homes. |

| Demographic Shifts | Growing demand from millennials reaching peak homebuying age. |

| Desirable Lifestyle | Attracting new residents to Colorado’s outdoor lifestyle and strong communities. |

| Limited Land Supply | Geographic and regulatory constraints on new housing development. |

| Investor Activity | Increased competition from investors for available homes. |

| Economic Recovery | Strong economic growth leading to increased housing demand. |

The Impact of the Great Recession on the Colorado Housing Market

The Great Recession significantly impacted the Colorado housing market, causing sharp declines in housing prices and a spike in foreclosure rates, leading to a market recovery that reshaped the state’s real estate landscape.

During this challenging period, many homeowners in Colorado faced financial difficulties and increased mortgage defaults, contributing to a substantial downturn in home sales and impacting homeownership rates.

However, the market’s resilience has since facilitated a gradual recovery, characterized by improved property values and a resurgence in buyer activity.

Changes in Housing Prices

The housing market in Colorado experienced a significant decline following the Great Recession, mirroring the overall instability in the real estate sector and influencing market analysis. As the economy began to recover, property values also started to rebound, resulting in a steady increase in home prices throughout the Centennial State, albeit at varying rates by region, driven by economic indicators and market predictions.

This recovery can be attributed to rising demand coupled with a tighter housing inventory, both of which have led to higher appraisal values, housing equity, and increased buyer competition.

For instance, metropolitan areas like Denver and Colorado Springs have witnessed particularly robust growth, with year-on-year price increases of approximately 10%. In contrast, rural areas in the southern part of the state have experienced more modest gains, closer to 5%.

Factors such as job growth, population growth, and the appeal of urban amenities have contributed to this regional disparity by attracting buyers to vibrant city centers, supporting community development, and housing sustainability. Additionally, persistently low interest rates and credit availability have played a crucial role, encouraging both new and seasoned buyers to purchase homes, which has further driven up housing prices across the board.

Shifts in Demand and Supply

The Colorado housing market has experienced significant changes in demand and supply dynamics, leading to frequent fluctuations that impact both buyers and sellers, including first-time homebuyers and those considering investment real estate. Factors such as population growth, urban sprawl, and evolving buyer preferences have contributed to a more competitive market, resulting in either a buyer’s market or a seller’s market.

Understanding these fluctuations is crucial for those in the real estate industry to make informed decisions regarding pricing and investment opportunities. Recent demographic shifts, including an influx of millennials seeking homeownership and retirees relocating to Colorado for a more favorable lifestyle, have further intensified competition, reflecting demographic analysis and relocation trends.

Economic indicators, such as job growth, rising wages, and the increasing cost of living in urban centers, have boosted demand, impacting local economies and housing demand. Additionally, limited housing inventory has exacerbated these challenges, underscoring the need for new developments and housing development projects.

Consequently, as buyers assess their options and sellers adjust their strategies, these variables significantly influence overall market dynamics, often leading to rapid changes in property values and availability, affecting both the luxury market and affordable housing.

Effects on Homeowners and Renters

Market fluctuations have significantly impacted homeowners and renters in Colorado, with many landlords choosing to sell their rental properties for quick cash. Rising housing prices and increasing rental rates have severely affected housing affordability and equity growth over the past several years, emphasizing the need for housing assistance programs and home buyer incentives.

For homeowners, the surge in property values has enhanced their equity, which can be accessed through refinancing, home equity loans, or equity release. In contrast, renters have faced challenges due to escalating rental prices and a growing shortage of affordable rental properties.

Understanding these trends, including renovation trends and buyer behavior, is crucial for both homeowners and renters who want to make informed decisions in the current market environment. Recent reports from the Colorado Association of REALTORS and Zillow indicate that the median home price in Colorado has risen to approximately $600,000, representing a nearly 10% increase over the past year, which can impact closing costs and home insurance.

While this rise boosts equity for homeowners, it also widens the gap between those who can afford to purchase a home and those who cannot, highlighting the importance of housing equity and market resilience.

On the rental side, a report from the Denver Metro Apartment Association reveals that average rents have increased by over 8%, forcing many renters to allocate more than 30% of their income to housing—an expenditure often linked to housing insecurity and the challenges of the rental market.

The heightened competition for available rentals often compels individuals and families to settle for substandard locations and living conditions, exacerbating a housing crisis that has been developing for years. This situation underscores the urgent need for affordable housing programs and housing legislation in the state.

Current State of the Housing Market in Colorado

The current housing market in Colorado is characterized by a tight inventory, with high home prices making it challenging for both buyers and renters to find affordable options, particularly affecting first-time homebuyers. Demand continues to exceed supply, resulting in a competitive market, particularly in popular suburban areas, where suburbanization and urbanization are prominent. One of the growing concerns is housing affordability for first-time homebuyers and renters, which makes it essential to examine the state of the market closely, considering the impacts of online listings and virtual tours.

Colorado Housing Market Trends 2023

According to the Colorado Association of Realtors, the number of homes sold in Colorado has decreased by 21.9% year-over-year, totaling 58,848 units sold in 2023. The average sales price in the state has also fallen by 1.28% from the previous year, settling at $654,355 in 2023, reflecting the influence of financial markets and market forecasts. The S&P CoreLogic Case-Shiller U.S. National Home Price Index indicates that home prices rose by 22% between the onset of the pandemic impact in March 2020 and April 2022, but have since declined by 9.33% from their all-time high of $413,000 in May 2022.

As of March 2023, the median home price in Colorado is $373,000, which is an increase from $356,000 in 2020 but a decrease from the $413,000 peak in 2022. Although Colorado’s median home price is higher than the U.S. median of $378,000, it remains more affordable than the all-time high of $413,000 recorded in 2022. The statewide median sales price stands at $654,355, while prices in the Denver metro area average $748,050. Additionally, the median rental price for apartments in the Denver-Aurora-Lakewood area reached $2,265 in 2023, up from $2,145 in 2022, highlighting the role of property management and community amenities.

According to the Colorado Division of Housing (DOH), the state is also experiencing significant growth in homebuilding, with a 38% increase in the total number of housing permits issued in 2022 compared to the previous year, reflecting higher housing start rates and construction rates. New home sales are expected to continue rising in 2023, with projections of 9,980 new homes sold, reflecting a 54% increase from 2022. However, supply chain challenges and labor shortages are anticipated to persist, impacting the construction industry in 2023, and influencing new developments and green building initiatives.

Colorado Housing Market Analysis 2023

While the Colorado housing market is facing a challenging year, characterized by demand outpacing supply and high prices creating affordability issues, the state is expected to see growth in homebuilding and an ongoing demand for new homes. The DOH predicts a 17% increase in demand for new homes in 2023, with new home sales projected to grow by 6%, despite slow sales and high vacancy rates in the existing housing market, underlining the importance of real estate investment trusts (REITs) and home inspections.

This growth is driven by several factors, including the ongoing trend of urban-to-suburban migration, growth in the tech industry and telecommuting, as well as overall population growth in the state. DOH Executive Director Alison George has noted that the housing market is undergoing a paradigm shift due to these dynamics, highlighting the importance of addressing the housing affordability crisis.

Colorado Housing Market Forecast 2023

The Colorado housing market is expected to continue facing challenges in 2023, with demand for new homes consistently exceeding supply and high prices contributing to affordability concerns. However, growth in homebuilding, fueled by suburban growth and urban development, and an increased demand for new homes are anticipated as the market stabilizes.

The DOH forecasts a resurgence in construction in 2023 following a slowdown caused by the COVID-19 pandemic, predicting an increase in housing units created in the state by 10% to about 12,000 units. This growth in homebuilding is critical for tackling the housing affordability crisis and ensuring that the demand for new homes can be adequately met.

Recent Trends in Housing Prices

Recent trends in housing prices in Colorado indicate steady appreciation, driven by strong demand and limited inventory in many areas. This upward trajectory reflects ongoing interest in real estate investment and highlights Colorado’s appeal as a desirable location for both newcomers and long-time residents, despite challenges like rising property values and mortgage rates.

Market analysis suggests that this trend is likely to persist, although fluctuations may occur based on broader economic indicators such as interest rates and economic recession.

Recent data shows that the average home price in Colorado has risen significantly; the median home price reached $579,000 in July 2023, compared to $525,000 in July 2022, marking a 10% increase year-over-year.

Factors such as low mortgage rates, a growing job market, and an influx of residents seeking additional space have propelled this growth. The state’s unique combination of outdoor lifestyle and urban amenities continues to attract both young professionals and families.

However, experts caution that rising interest rates and potential economic downturns could introduce volatility into the market, urging stakeholders to remain vigilant and prepared for changing conditions.

Availability of Housing Inventory

The availability of housing inventory in Colorado is a significant concern. Demand consistently exceeds supply, resulting in a saturated market and increased competition among buyers. Factors such as zoning laws, building permits, construction rates, and urban planning directly impact the availability of new homes and rental properties, thereby influencing the overall market dynamics.

Developing solutions to these inventory challenges is essential for creating a balanced housing market.

Statistics indicate a severe shortage of inventory; new listings have declined by over 20% in recent months. This decline is largely attributed to restrictive zoning regulations that determine where new developments can be built, as well as lengthy permitting processes that can take months or even years to complete. Additionally, construction has failed to keep pace with population growth, exacerbating the inventory crisis.

Without effective reforms and innovations in housing policy, the gap between supply and demand is likely to widen, leaving many potential buyers and renters trapped in an increasingly competitive and rapidly evolving environment.

Impact on Affordability

Current market conditions have adversely impacted housing affordability in Colorado, leading to increased home prices and rental rates. The demand for housing, particularly from first-time buyers, has surged, highlighting the challenges many individuals and families face in finding suitable housing within their budget, as indicated by the affordability index.

This situation underscores the importance of understanding the underlying causes of these affordability issues and exploring potential solutions to mitigate them.

Key trends contributing to this crisis include:

- the ongoing rise in material costs,

- supply chain disruptions,

- a shortage of available inventory,

all of which make it more difficult for buyers to purchase homes at reasonable prices. Recent statistics show that average home prices have risen by over 10% in the past year, while rental rates have similarly increased, prompting many to reconsider their housing options.

This situation not only affects those aspiring to buy their first home but also places additional pressure on renters, who may find themselves needing to move farther away from city centers to secure more affordable housing.

To address these challenges, potential solutions such as enhancing affordable housing initiatives and expanding access to financial assistance programs could provide much-needed relief for individuals and families in need.

Future Predictions for the Colorado Housing Market

Future predictions for the Colorado housing market indicate that current trends are likely to continue, with expected changes in housing prices driven by ongoing economic recovery and demographic shifts.

Colorado Housing Market Trends 2024

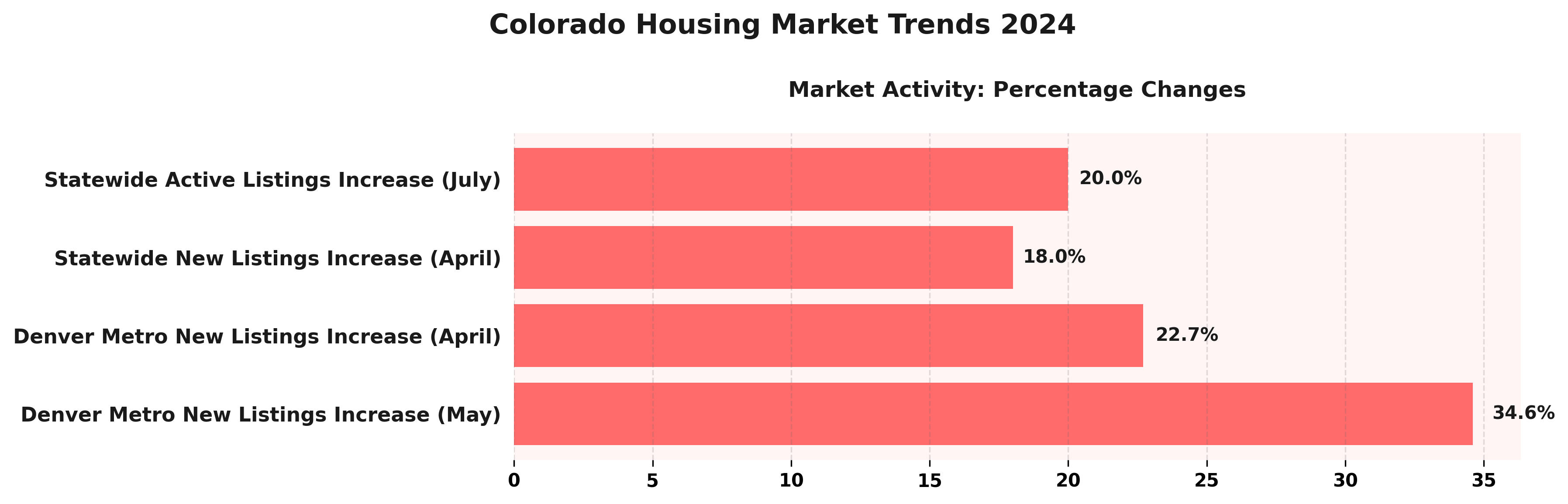

The Colorado Housing Market Trends 2024 data provides a detailed look at the fluctuations in housing market activity, particularly focusing on the rise in new and active listings. This information is crucial for understanding the dynamics of supply and demand within the state’s real estate sector.

Market Activity in the Denver Metro area shows a significant uptick in new listings, with a 34.6% increase in May and a 22.7% increase in April. These figures suggest a strong seller’s market, where homeowners are taking advantage of current conditions to list their properties. The notable increase from April to May may indicate a response to seasonal trends or economic factors encouraging more activity.

- Statewide, new listings increased by 18.0% in April, slightly lower than the Denver Metro area, reflecting varied market conditions across regions. This increase still points to a healthy market statewide, with more properties becoming available for buyers, potentially easing some competition among buyers and affecting buyer behavior.

- The 20.0% increase in active listings statewide in July suggests that not only are more properties being listed, but they’re also staying on the market longer, which could indicate a shift towards a more balanced market. This balance could offer buyers more choices and negotiating power, contrasting with the intense competition of previous months, aligning with new developments and suburbanization trends.

These percentage changes in listings reflect dynamic shifts in the Colorado housing market, potentially influenced by factors such as economic changes, interest rates, and seasonal behaviors. As more properties come to market, the competitive landscape may shift, impacting pricing strategies and buyer behavior. Stakeholders, including real estate agents, buyers, and sellers, can use this data to make informed decisions as they navigate the evolving market conditions in 2024.

Expected Changes in Housing Prices

Expected changes in housing prices in Colorado indicate a likely increase. This rise in housing prices will be driven by the interplay of a steady housing market along with demand and supply factors. As more homebuyers enter the market, competition will intensify, potentially leading to higher appraisal values, which will in turn exert upward pressure on housing prices.

It is crucial for both buyers and investors to understand these dynamics as they navigate the evolving real estate landscape.

An analysis of Colorado’s housing market by leading real estate researchers highlights several key elements influencing this change. These elements include low interest rates, which make mortgages more accessible, limited inventory as new construction fails to keep pace with demand, and demographic shifts leading to increased migration patterns and urbanization.

Additionally, economic indicators such as job growth and demographic shifts are contributing to an influx of new residents seeking housing in desirable areas. By monitoring these variable factors, stakeholders can better position themselves to make strategic decisions while effectively managing the risks associated with a volatile market.

Projected Shifts in Demand and Supply

Projected changes in demand and supply within the Colorado housing market indicate a persistent imbalance, with demand anticipated to outstrip supply in the foreseeable future. This trend implies that more buyers will compete for a limited number of properties, potentially worsening issues related to affordability and availability.

Understanding these projected shifts is crucial for both real estate agents and prospective homeowners as they navigate the evolving market. Economic indicators suggest population growth, driven by job creation and a desire for the state’s outdoor lifestyle, which experts predict will lead to an influx of new residents seeking housing.

Recent data shows that Colorado’s population growth rate is projected to be 1.5% per year over the next five years, resulting in an increasing number of individuals and families searching for homes. Meanwhile, supply chain disruptions and rising construction costs continue to hinder new developments, further tightening the housing inventory.

This combination of rising demand and stagnant supply is expected to intensify market pressures, driving home prices higher and solidifying Colorado as a competitive landscape for both buyers and investors. The real estate trends indicate that property values are being affected by these economic factors, emphasizing the importance of thorough market analysis.

Anticipated Effects on Homeowners and Renters

The anticipated effects of emerging market trends on homeowners and renters in Colorado encompass challenges related to housing affordability, equity, and availability. Homeowners may experience an increase in equity, whereas renters may face rising rental prices and reduced availability due to the competitive rental market.

Both homeowners and renters must understand these anticipated effects as they navigate the evolving housing market, especially amidst changing economic indicators.

For homeowners, the combination of rising interest rates and increasing demand for housing presents additional challenges. According to statistics, the average property value in Colorado rose by nearly 10% in the past year due to demographic shifts and migration patterns. While this may be beneficial for some homeowners, it exacerbates the affordability crisis for renters, particularly those earning less than the median income.

A recent survey indicated that nearly 40% of renters are concerned about escalating costs and dwindling availability, suggesting that many are reaching a breaking point. The current housing crisis reflects these concerns.

As these market trends unfold, it is essential for both homeowners and renters to stay informed and educated about their options in an uncertain environment, where urban development and suburban growth play critical roles.

Frequently Asked Questions

What is the current state of the housing market in Colorado?

The housing market in Colorado has seen a significant increase in home prices over the past decade, making it one of the fastest-growing markets in the country. This growth is influenced by several factors including construction rates, suburbanization, and urbanization, which impact both single-family homes and multifamily units.

How have home prices changed in Colorado over the last 10 years?

Home prices in Colorado have increased by an average of 7-8% each year for the past decade, with certain cities experiencing even higher growth rates.

What factors have contributed to the rise in home prices in Colorado?

The population growth in Colorado, along with a shortage of housing inventory, low mortgage rates, and a strong economy, have all played a role in the increase of home prices over the past decade. The demand and supply imbalance, coupled with economic factors like pandemic impact and economic recovery, further drive this trend.

How has the housing inventory in Colorado changed over the last 10 years?

The housing inventory in Colorado has remained low compared to the demand for homes, leading to a highly competitive market for buyers.

Have there been any changes in the types of homes being built in Colorado over the past decade?

There has been a shift towards more multi-family units, such as apartments and townhomes, being built in Colorado over the past decade, due to the high demand for affordable housing in urban areas. This trend reflects changes in zoning laws and urban planning strategies aimed at addressing housing inventory shortages and supporting community development.

How do the current housing prices in Colorado compare to the rest of the country?

The housing prices in Colorado are higher than the national average, but still more affordable than states like California and New York. However, the rate of growth in home prices has been higher in Colorado compared to the national average, influenced by buyer competition and new developments that have shaped the housing landscape.