The Denver real estate market in November 2024 displayed resilience and challenges, providing a fascinating snapshot of the area’s housing dynamics.

Here’s a detailed breakdown of this month’s key trends and data points.

| Category | Details |

|---|---|

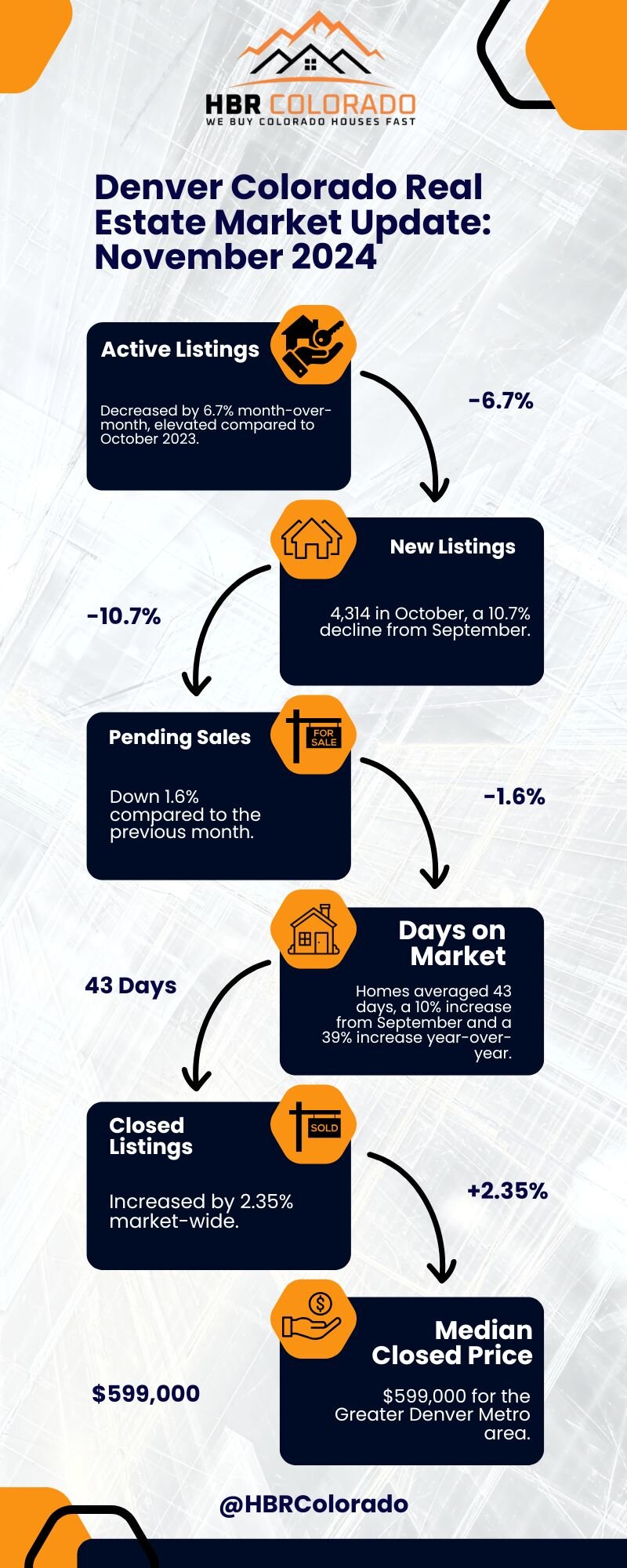

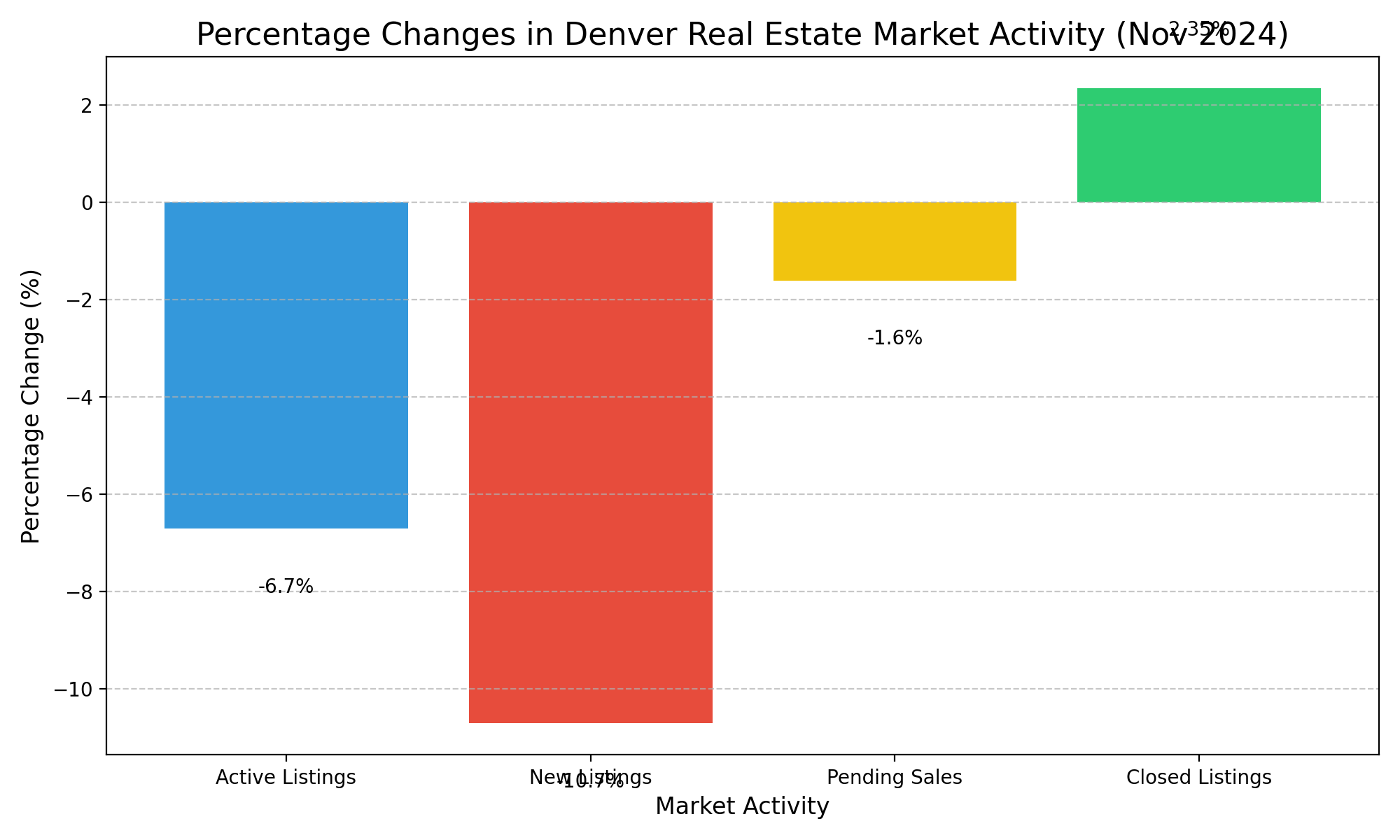

| Active Listings | Decreased by 6.7% month-over-month, elevated compared to October 2023. |

| New Listings | 4,314 in October, a 10.7% decline from September. |

| Pending Sales | Down 1.6% compared to the previous month. |

| Closed Listings | Increased by 2.35% market-wide. |

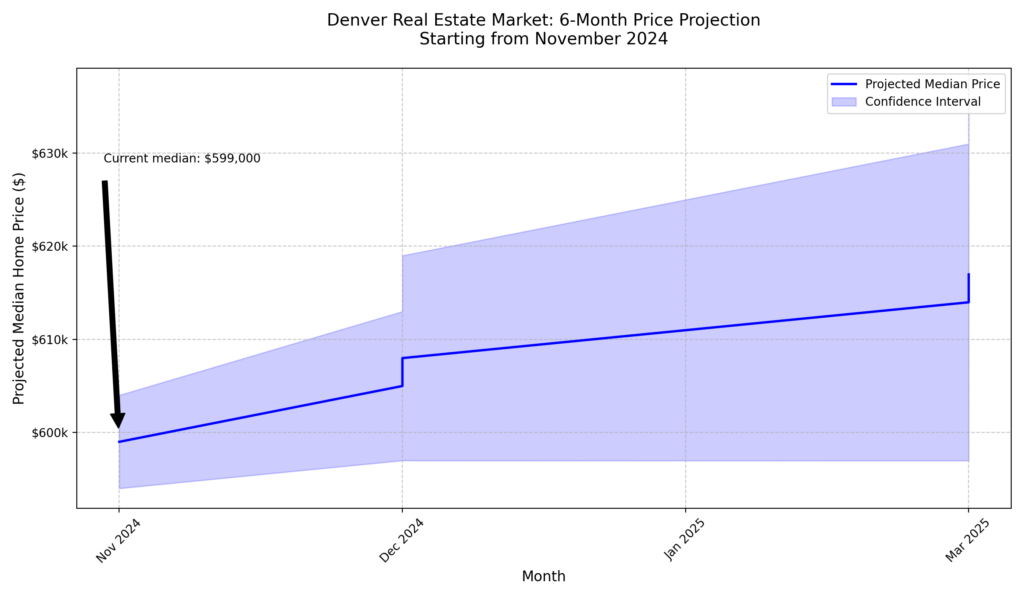

| Median Closed Price | $599,000 for the Greater Denver Metro area. |

| Average Home Prices |

|

| Days on Market | Homes averaged 43 days, a 10% increase from September and a 39% increase year-over-year. |

| Inventory Levels | Highest levels since 2011. |

| Key Trends |

|

Market Overview

The Denver housing market experienced notable changes in November:

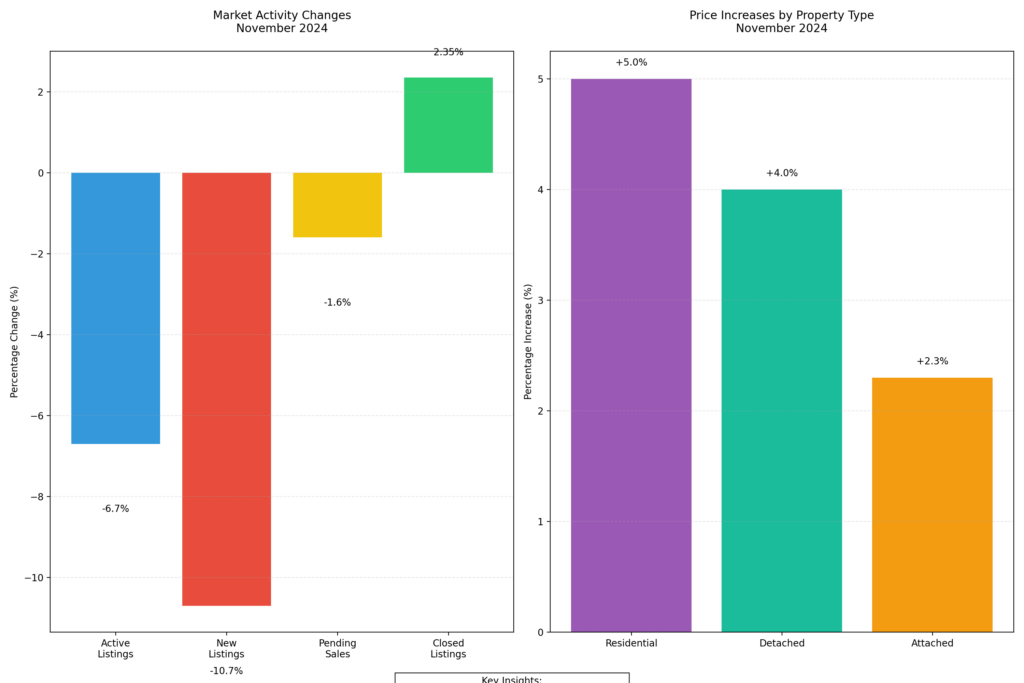

- Active Listings: The number of active listings decreased by 6.7% compared to October but remained higher than in November 2023. This decline suggests seasonal adjustments as the market slows heading into winter.

- New Listings: 4,314 new listings were recorded in October, reflecting a 10.7% drop from September.

- Pending Sales: Pending sales fell by 1.6% month-over-month, highlighting a more cautious buyer approach as interest rates and economic conditions influence decisions.

- Closed Listings: Despite slower pending sales, closed listings increased by 2.35%, indicating successful transactions in the pipeline.

Prices and Sales Trends

Price trends in November reveal the market’s resilience:

- Median Closed Price: The median closed price in the Greater Denver Metro area stood at $599,000, maintaining stability despite broader affordability challenges.

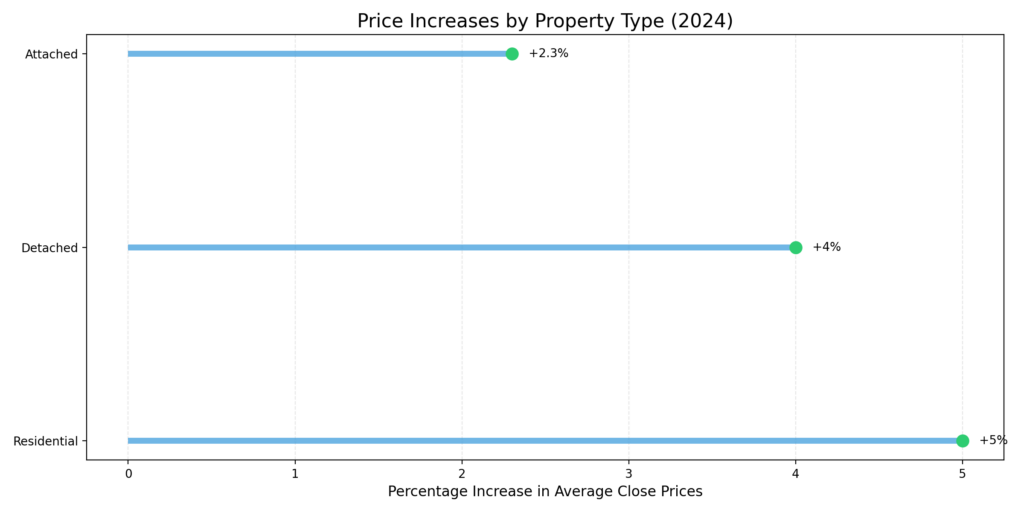

- Average Close Prices: Residential properties saw a 5% increase in average close prices, with detached homes rising by 4% and attached homes by 2.3%.

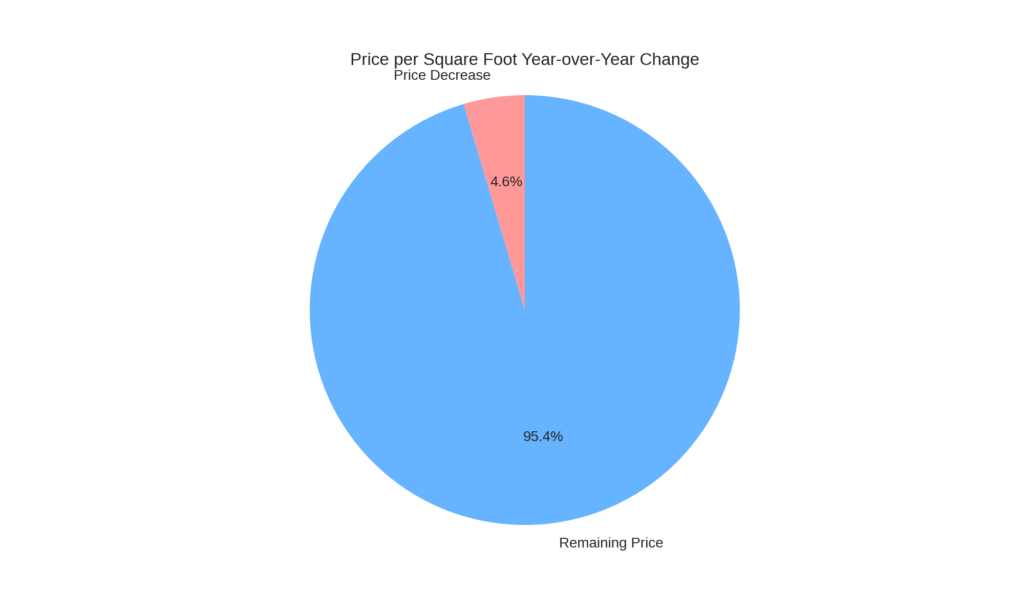

- Year-to-Date Price Trends: On a year-over-year basis, average home prices in Denver increased by 3%, underscoring steady growth in a balanced market.

Market Conditions

Several market conditions are shaping Denver’s real estate landscape:

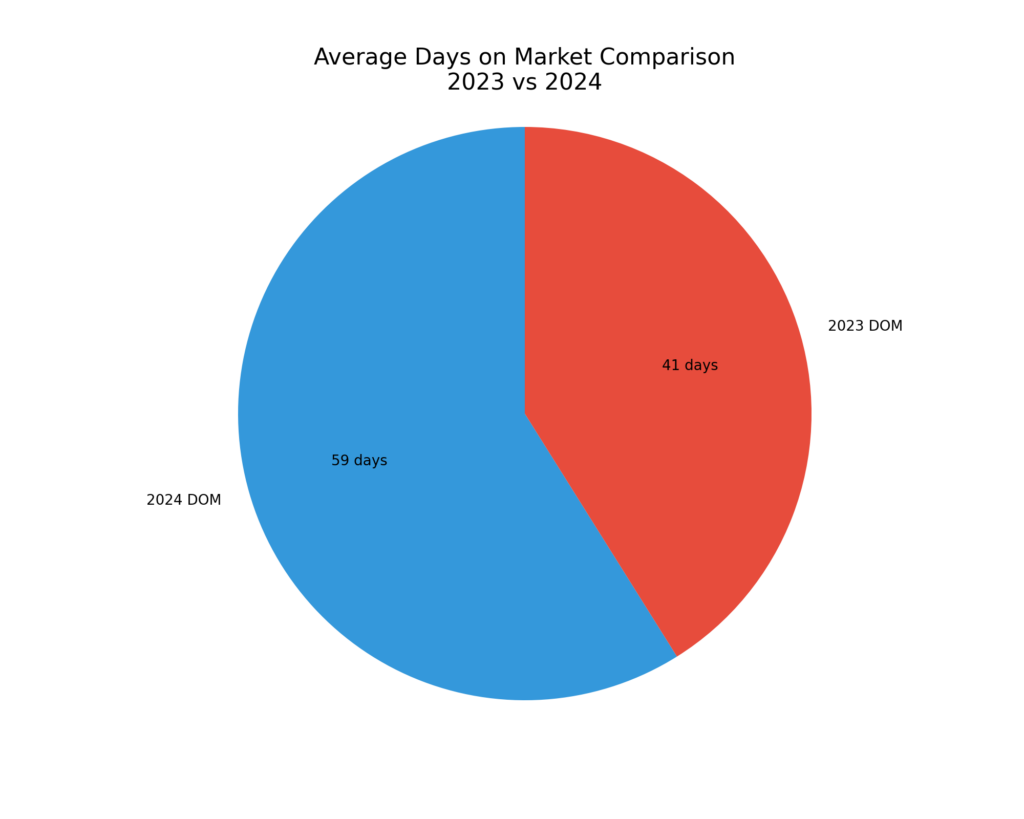

- Days on Market: Homes spent an average of 43 days on the market, a 10% increase from September and a 39% jump compared to the previous year. This extended timeframe reflects buyer caution and negotiation leverage.

- Attached Home Market Strength: Attached homes, such as condos and townhouses, displayed unexpected strength, with pending sales increasing across various price brackets. This segment continues to attract buyers seeking affordability and urban convenience.

- Inventory Levels: Inventory levels are at their highest since 2011, providing buyers with more options and reducing the urgency to make quick decisions.

Key Trends

- Interest Rates Influence Activity: Lower interest rates have encouraged some buyers to re-enter the market, leveraging the opportunity to secure properties at slightly reduced prices.

- Condo Market Defies Expectations: Despite affordability concerns, condos and other attached homes saw increased activity, benefiting from the demand for more cost-effective housing options.

- Seasonal Opportunities for Buyers: The fourth quarter traditionally provides buyers with more leverage. Elevated inventory and slower market activity allow for greater negotiation opportunities.

Higher Property Taxes Are Impacting Condo Sales In Denver

Higher property taxes are contributing to affordability challenges for condos in Denver, but surprisingly, the condo market is showing unexpected strength despite these headwinds:

- Property taxes have increased significantly, with 63% of Coloradans now paying above the U.S. average[1]. The assessment rate is set to increase from 0.0670 to 0.0715 in 2025, further impacting property taxes.

- Despite these challenges, Denver’s attached home market is defying expectations with increased activity:

- Pending home sales for attached homes in the $500,000 to $749,000 bracket surged 24%.

- In the $750,000 to $999,000 bracket, closed sales jumped by 41%.

- For the $1 million-plus market, pending sales soared by 63%.

- The surge in condo activity is attributed to buyers capitalizing on seller discounts and a dip in mortgage rates, which hit a 19-month low of 6.1% in September.

- However, the condo market still faces significant hurdles, including increased insurance premiums and rising HOA dues, with Colorado ranking #4 in the country for highest HOA dues.

This unexpected strength in the condo market suggests that while higher property taxes are a concern, other factors such as lower interest rates and potential discounts are currently outweighing these challenges for many buyers in Denver.

New Listings Compared To Last Year’s Numbers in Denver

New listings in the Denver metro area have increased significantly compared to last year:

- In May 2024, new listings were up 28% year-over-year, with 6,779 properties added to the market.

- For October 2024, there were 4,314 new listings, compared to 3,627 in October 2023, representing an 18.9% increase.

- The luxury market ($1 million+) saw a surge in new listings earlier in the year, with a 44% increase in May compared to the previous year.

However, it’s important to note that despite these increases, the market is showing signs of seasonal slowdown:

- In July 2024, new listings decreased 11.58% month-over-month, although they were still up 7.58% year-over-year.

- October 2024 saw a 10.7% decrease in new listings compared to September 2024.

These trends indicate a dynamic market with significant year-over-year growth in new listings, but also typical seasonal fluctuations.

Factors Contributing To The Increase In New Listings In Denver

Several factors are contributing to the increase in new listings in Denver:

- Inventory growth: New listings have outpaced sales, leading to the highest inventory levels in nearly a decade.

- Shifting market conditions: The market is transitioning towards more balance, encouraging some sellers to list their homes.

- Seasonal trends: While there was a slight decrease in July, the overall trend shows significant year-over-year increases in new listings.

- Diverse seller motivations: Not all homeowners are tied to their low interest rates, leading some to list their properties despite higher current rates.

- Price stabilization: With median prices showing modest year-over-year increases, some sellers may be motivated to list while prices remain high.

- Increased options for sellers: The more balanced market provides sellers with opportunities to buy as well, potentially encouraging them to list their current homes.

- Economic factors: Denver’s strong job market and population growth continue to drive housing demand, potentially motivating sellers to enter the market.

This combination of factors has resulted in a significant increase in new listings, with the Denver metro area seeing a 34.6% rise in May 2024 compared to the previous year.

What Seasonal Trends Are Contributing To New Listings In Denver?

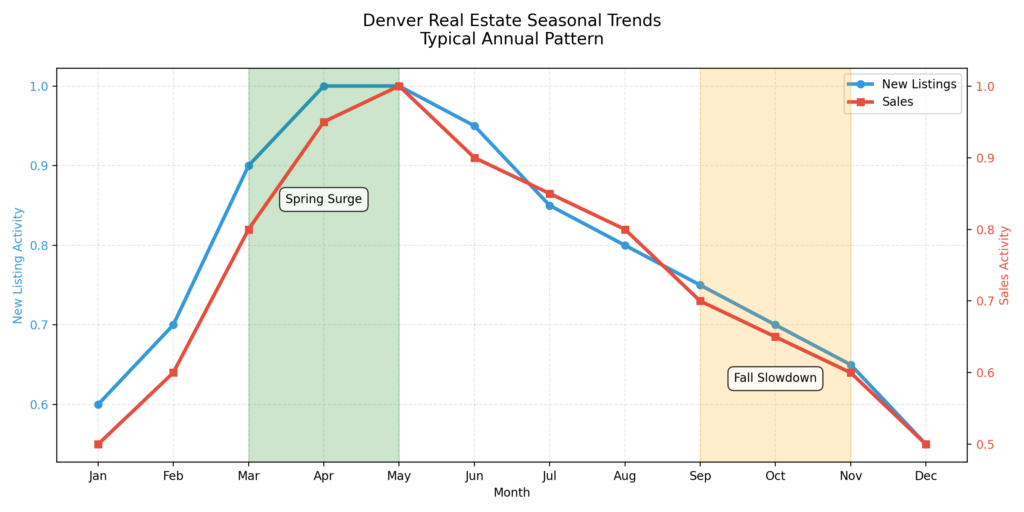

The Seasonal trends influencing new listings in Denver are:

- Spring and summer surge: The market typically experiences an increase in listings during the spring and summer months as homeowners aim to sell while the weather is favorable.

- Fall slowdown: As Denver transitions into fall, the number of new listings tends to decrease. Some homeowners who didn’t sell during summer may choose to wait until the next spring.

- July dip: July is traditionally a time when the Denver real estate market takes a break. In July 2024, there was an 11.58% decrease in new listings month-over-month, although they were still up 7.58% year-over-year.

- End of summer decline: As the summer selling season winds down throughout August, there’s typically a change in the marketplace.

- Winter lull: While not explicitly mentioned in the search results, it’s common for real estate markets to experience a slowdown in new listings during the winter months.

Despite these seasonal trends, it’s important to note that the Denver market has been described as unpredictable, with some traditional patterns being disrupted.

For example, there was a significant year-over-year increase in new listings in May 2024, with the Denver metro area seeing a 34.6% increase compared to the previous year.

Outlook for Denver’s Real Estate Market

While high inventory levels and affordability challenges remain concerns, the stability in home prices and the resurgence of buyer interest signals a healthy market. Denver continues to attract both local and out-of-state buyers, making it a resilient hub for real estate investment.

Whether you’re looking to buy or sell, understanding the current market dynamics is crucial. The Denver real estate market offers opportunities for both parties, especially as the year concludes and prepares for a potential spring surge.