In Colorado, it is possible to buy a house for $1 through a gift of equity, enabling family members to assist each other in transferring ownership of real estate property.

This article explores the benefits and risks associated with purchasing a house for $1 in Colorado, including aspects such as lower down payments and tax implications.

Additionally, it outlines the steps to take for a successful transaction and presents alternative options to consider. Whether you are looking to buy a house for yourself or a family member, you will find valuable information here.

Is It Possible To Buy A House For $1 In Colorado?

In Colorado, the notion of purchasing a house for $1 is often seen as fanciful. However, various creative approaches, such as familial arrangements or unique real estate transactions, could theoretically make this possible.

The legal complexities associated with such a property transfer usually necessitate a thorough understanding of the market’s regulatory framework, financial implications, and compliance with local regulations governing real estate practices.

What Is A Gift Of Equity?

A gift of equity occurs when a family member sells their home to another family member for less than its fair market value, effectively allowing the seller to transfer a portion of the property’s value as a gift to the buyer.

This type of transaction offers several significant advantages, including reduced closing costs and potentially favorable tax implications. However, it also necessitates careful consideration of property valuation and the legal aspects of the conveyance.

What Are The Benefits Of Buying A House Through A Gift Of Equity?

Buying a house through a gift of equity offers several benefits, particularly for family members looking to simplify the home buying and selling process for each other.

These advantages may include:

- Lower down payment requirements

- Exemption from mortgage insurance

- Potential tax benefits associated with equity gifts

1. Lower Down Payment

One of the most significant advantages of a gift of equity when purchasing a home is that it enables a much lower down payment, which is particularly beneficial for buyers who may struggle to save the traditional 20%. This financial aspect often makes homeownership more attainable, especially in areas like Colorado, where real estate prices are high.

For instance, a first-time buyer in a competitive market may only need a 5% down payment instead of the standard 20% due to the gift of equity. This not only saves the buyer thousands of dollars upfront but also lowers the monthly mortgage payment, resulting in improved cash flow for other essential expenses, such as childcare or commuting costs.

For buyers who wish to purchase a home but lack sufficient savings, this option can serve as a valuable alternative. Family members can provide the gift of equity, allowing the buyer to make their purchase sooner than they otherwise could.

2. No Need For Mortgage Insurance

Purchasing a home through a gift of equity typically eliminates the need for mortgage insurance, which is a significant cost that many first-time buyers encounter when financing a property using conventional terms.

By removing this additional expense, buyers can experience considerable cost savings, making the home-selling process more attractive. This approach not only enhances the overall affordability of the home-buying experience but also enables buyers to allocate their finances toward other essential aspects of homeownership, such as renovations or immediate expenses.

Avoiding mortgage insurance can improve the buyer’s financial situation by increasing their monthly cash flow, allowing them to invest in property maintenance or save for future needs. Additionally, this method often results in a smoother transaction, as sellers may find the appeal of a less costly closing process favorable, ultimately benefiting both parties and creating a win-win scenario in the housing market.

3. Potential Tax Benefits

Buyers of properties acquired through a gift of equity may benefit from potential tax advantages that can lower the overall costs of home ownership. These benefits may include exemptions from certain property taxes and preferential treatment under capital gains tax rules, depending on the structure of the transaction.

Sellers also enjoy advantages, such as reduced capital gains tax if the property has been held for a long time. For instance, if a seller gifts $100,000 in equity, this amount is deducted from the taxable basis when the property appreciates and is sold in the future.

The gift of equity allows the buyer to have a lower purchase price, which eliminates the need for private mortgage insurance and enhances affordability while improving qualifications for better loan terms.

Understanding these tax implications can create a win-win situation for both parties, facilitating a smoother transaction.

What Are The Potential Risks Of Buying A House Through A Gift Of Equity?

The gift of equity presents several risks and potential issues for buyers. These include the possibility of an inflated appraisal value, which can lead to future complications; complex gift tax implications that require careful consideration; and legal issues that may arise if proper documentation is not followed.

Buyers need to be aware of and cautious about these risks and challenges.

1. Inflated Appraisal Value

The primary risk associated with a gift of equity transaction is the possibility that the appraised value of the property may be inflated and not accurately reflect its fair market value. This discrepancy can lead to complications regarding financing and tax obligations for both the buyer and the seller in the real estate transaction.

When such inconsistencies arise, they can hinder the buyer’s ability to secure financing and may expose the seller to unexpected tax liabilities. If the appraisal is artificially high, the buyer may end up overpaying for the property, which could negatively impact their equity position and overall investment.

Lenders may approach inflated appraised values with skepticism, resulting in a longer approval and closing process. Additionally, there can be legal ramifications, as misreporting property values may lead to disputes or audits with taxing authorities.

Therefore, all parties involved should ensure that appraised values are accurate and defensible.

2. Gift Tax Implications

Gift tax implications represent a significant risk associated with selling a home through a gift of equity. In some cases, sellers may not fully understand the nuances of these transactions and inadvertently exceed the annual exclusion set by the IRS, resulting in unexpected taxes that can disrupt the long-term financial plans of all parties involved.

The IRS permits individuals to gift a certain amount each year without incurring a gift tax; for 2023, this limit is $17,000 per recipient. However, when a home is involved—especially under the gift of equity structure—the appraised value of the gift can far exceed this annual exclusion limit.

This discrepancy can lead to complex tax implications that sellers may not anticipate, potentially resulting in liabilities that impact their long-term financial strategies. Therefore, both givers and receivers need to be well-informed about these regulations.

3. Legal Issues

Legal issues can arise in a gift of equity transaction if proper legal documentation is not followed, potentially leading to disputes over ownership rights or conditions of sale. Compliance with real estate laws and local ordinances is essential to prevent future complications.

Inadequate documentation can result in disagreements between the parties involved, which may necessitate legal intervention. All parties should ensure that all documents, including the gift deed and any agreements related to the equity transfer, are clearly defined and legally enforceable.

Additionally, it is important to be aware of the potential tax implications of such transactions, as these may affect the financial responsibilities of the parties involved. By prioritizing thorough documentation and understanding the legal ramifications of these arrangements, individuals can effectively protect their interests and ensure that the transaction remains transparent.

How To Buy A House Through A Gift Of Equity In Colorado?

To buy a house with a gift of equity in Colorado, several important steps must be followed.

- Obtaining a professional appraisal to determine the property’s fair market value.

- Drafting a formal gift of equity agreement.

- Preparing for any potential closing costs associated with the transfer.

Adhering to these steps will help ensure a smooth process and compliance with local laws.

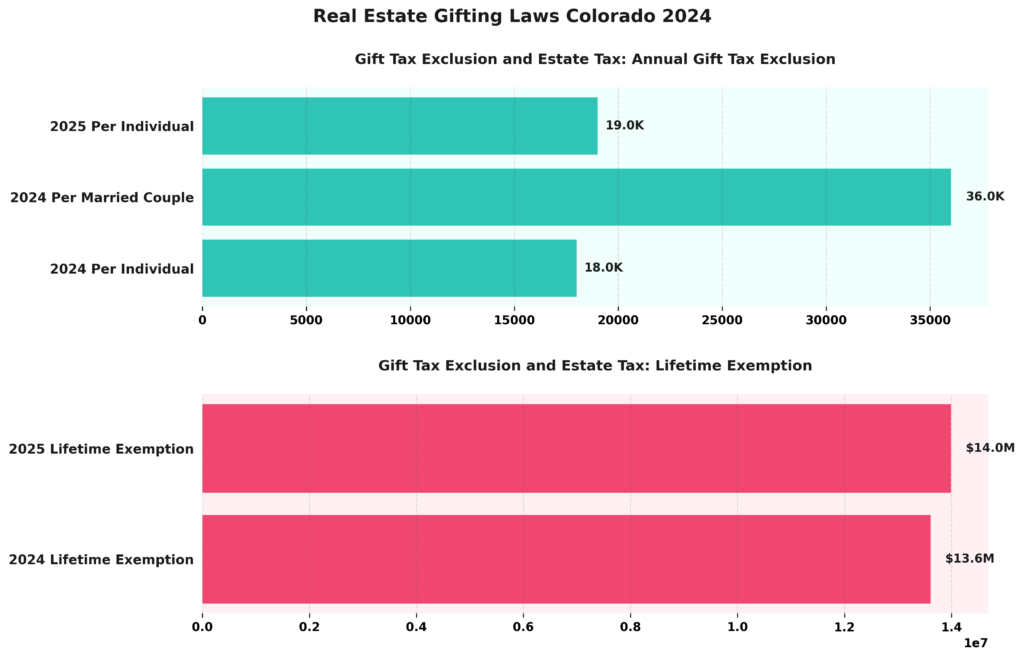

Real Estate Gifting Laws Colorado 2024

The Real Estate Gifting Laws Colorado 2024 data provides insights into the current and forthcoming gift tax exclusions and lifetime exemptions, which are crucial for estate planning and transferring wealth through gifts. Understanding these legal thresholds can significantly affect financial strategies for individuals and couples considering gifting real estate or other assets.

Gift Tax Exclusion details for 2024 indicate that individuals in Colorado can gift up to $18,000 per recipient without incurring a gift tax, a crucial consideration in estate planning. For married couples, this amount doubles to $36,000, allowing for more substantial tax-free transfers through gifting property. This threshold is set to increase in 2025, with the per-individual exclusion rising to $19,000, reflecting adjustments for inflation, cost-of-living changes, and real estate market conditions. These exclusions facilitate strategic gifting, enabling individuals to transfer wealth incrementally without tax implications.

Lifetime Exemption figures highlight significant opportunities for tax-free wealth transfer. The 2024 lifetime exemption sits at $13,610,000, increasing to $13,990,000 in 2025, facilitating significant asset transfer and estate taxation planning. This substantial exemption allows individuals to gift or bequeath sizeable estates over their lifetime without estate or gift tax, making it a critical component of estate planning for high-net-worth individuals.

These exclusions and exemptions underscore the importance of planning and awareness of state-specific laws in Colorado. By leveraging the annual exclusions and lifetime exemptions, individuals and families can effectively manage their estate taxes, ensuring maximum wealth transfer to heirs while minimizing tax burdens and legal proceedings.

1. Get A Professional Appraisal

The first step in purchasing a house through a gift of equity is to obtain a professional appraisal to accurately determine the property’s fair market value, ensuring that the transaction is financially sound. This valuation is essential for both the buyer and seller, as it helps guide their negotiations in the property transaction.

A professional appraisal offers an impartial assessment of a property’s value, which is particularly important in a gift of equity transaction where emotional connections can cloud proper evaluations.

During the appraisal, a qualified third-party expert evaluates factors such as comparable sales, property condition, market trends, and fair market value. Understanding these factors allows all parties involved to make informed decisions and fosters transparency throughout the process.

An accurate valuation can facilitate the mortgage approval process, help determine tax implications, and ultimately contribute to a smoother property transaction, including the transfer of ownership rights. Additionally, an appraisal serves as a foundation for fair negotiations, giving all parties peace of mind that the terms are equitable for everyone involved in the transfer.

2. Draft A Gift Of Equity Agreement

A gift of equity agreement is a contract between the buyer and seller that is signed during the closing process, outlining the conveyance of real property. This agreement serves as the foundation of the transaction and safeguards the rights of both parties involved. It outlines the terms of the transaction, including the sale price of the property and the conditions of sale, ensuring compliance with legal requirements and real estate contracts, while providing clarity for both the buyer and the seller.

Along with detailing the property price, the gift of equity agreement typically includes important clauses that explain the nature of the gift, any conditions attached to it, and the method of payment. Clearly defining these aspects is crucial to minimize the risk of misunderstandings and disputes in the future.

Accurate documentation is also essential as it can address significant legal issues, such as tax implications and whether the transaction qualifies for the gift tax exemption. Understanding these implications protects both parties from potential complications later and ensures a smooth transfer of ownership.

3. Prepare For Closing Costs

As with any real estate transaction, preparing for closing costs is an essential obligation when buying a house through a gift of equity. Closing costs typically encompass fees associated with transferring the title and other legal and transactional expenses. Understanding these costs is crucial for both the buyer’s and seller’s financial planning to ensure a successful transaction.

Buyers should anticipate closing costs such as:

- Loan origination fees and escrow services

- Appraisal fees and home inspection costs

- Inspection fees

All of which can accumulate and significantly impact their budget. On the seller’s side, costs may include:

- Settlement fees

- Preparation fees for closing documents

- Any outstanding property tax bills must be settled before the transfer.

To effectively plan for these potential expenses, both buyers and sellers should engage in thorough financial planning and budgeting, setting aside approximately 3-5% of the purchase price to cover all closing costs.

Working with a real estate agent, professional home buyer, or financial advisor can provide valuable guidance and support throughout this complex process.

What Are The Alternatives To Buying A House Through A Gift Of Equity?

You can buy a house using a gift of equity, but there are also several alternative financing options available for homebuyers.

These options include:

- Seller financing and real estate investment possibilities

- Rent-to-own agreements

- Conventional mortgages

Each of these alternatives comes with its own set of advantages and disadvantages, influenced by the current real estate market and zoning laws.

1. Seller Financing

Seller financing is a method in which the seller acts as a lender to the buyer, allowing the buyer to make payments directly to the seller instead of a traditional mortgage lender. This arrangement can be beneficial for both parties, as it offers flexible terms and faster transaction closing times.

In seller financing, the seller provides the buyer with a promissory note that outlines the repayment schedule, interest rate, and any other relevant terms. This approach can be particularly advantageous in a tight credit market, where buyers may struggle to secure conventional loans.

For sellers, it expands their pool of potential buyers, especially those who are unable to obtain a traditional mortgage, while also allowing them to earn interest on the loan, making it an attractive real estate investment option. However, seller financing carries risks for sellers, including the possibility of buyer default and navigating complex legal issues.

Buyers might also encounter higher interest rates and less protection compared to traditional lending options.

2. Rent-to-Own

Rent-to-own agreements offer an alternative pathway to homeownership, allowing buyers to lease a property with the option to purchase it after a specified period. This model often facilitates the transition into property ownership by providing buyers with a trial period during which they can build equity in the home. During this time, prospective homeowners have the opportunity to evaluate the property and the surrounding neighborhood, ensuring that it meets their long-term needs before committing to purchase.

Typically, rent-to-own arrangements require the buyer to pay a monthly rent, a portion of which is credited toward the final purchase price, making homeownership and the eventual title transfer more attainable. These agreements can be particularly advantageous for individuals with less-than-perfect credit histories, as they provide an opportunity to improve their financial situations.

It is essential for buyers to understand their responsibilities, which may include regular maintenance and timely rent payments, to avoid forfeiting their investment and ensure compliance with local regulations.

3. Conventional Mortgage

A conventional mortgage is one of the most common methods for financing a home purchase. To qualify, buyers must meet specific credit and income criteria.

The complexities and requirements of the mortgage process often make it necessary to enlist the assistance of a buyer’s agent. Lenders typically seek a solid credit score, usually over 620, stable income, and a low debt-to-income ratio to ensure that buyers can meet their repayment obligations.

A buyer’s agent can be beneficial not only in finding properties but also in negotiating and understanding the terms of financing. Additionally, buyers should be aware of varying down payment requirements and the importance of securing pre-approval.

A buyer’s agent can facilitate this process by providing insights into the current market and clarifying what lenders are looking for.

Frequently Asked Questions

Can a family member sell me their house for $1 in Colorado?

Yes, a family member can sell you their house for $1 in Colorado.

Is selling a house for $1 considered a gift in Colorado?

Yes, selling a house for $1 is considered a gift under Colorado law, with potential tax implications.

What are the tax implications of selling a residential property for $1 in Colorado?

Since selling a house for $1 is considered a gift, there may be gift tax implications. It is important to consult with a tax professional for specific advice.

Can a family member sell me their house for $1 without a real estate agent or legal advice in Colorado?

Yes, a family member can sell you their house for $1 without a real estate agent in Colorado. However, it is recommended to consult with a legal professional to ensure all necessary paperwork and legal requirements are met.

Is there a specific process for selling a house for $1 in Colorado?

While there is no specific process for selling a house for $1 in Colorado, it is important to have a written contract and to follow all applicable state laws and regulations, including those related to real estate transactions and buyer-seller relationships.

Can I buy a house for $1 from a family member as an investment property in Colorado?

Yes, you can buy a house for $1 from a family member as an investment property in Colorado. However, it is important to consider all financial and legal implications before making a decision.